Preparing a statement of cash flows. (Adapted from a problem prepared by Stephen A. Zeff.) Selected information

Question:

Preparing a statement of cash flows. (Adapted from a problem prepared by Stephen A. Zeff.) Selected information from the accounting records of Breda Enterprises Inc. appears below. The firm uses a calendar year as its reporting period. You are asked to prepare a statement of cash flows for Breda Enterprises Inc. for Year 6. Key all figures in the statement of cash flows to the numbered items below.

(1) Net income for Year 6 is \(\$ 90,000\).

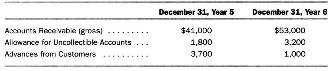

(2) Beginning and ending balances in three accounts relating to the firm's customers were as follows:+

On November 1, Year 6, a customer gave the firm a six-month, 8-percent, \(\$ 15,000\) note in satisfaction of an account receivable of \(\$ 15,000\). Interest is payable at maturity. This was the only note receivable held by the company during Year 6.

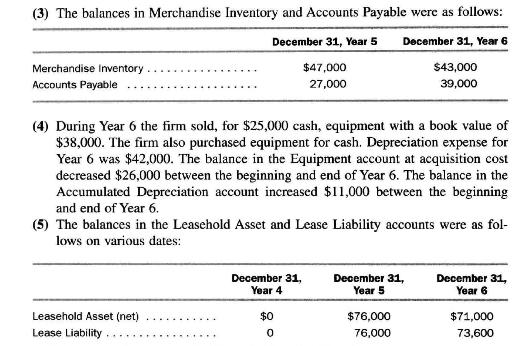

On December 31, Year 5, the firm signed a long-term lease which, by its terms, qualified as a capital lease. The firm made a payment under the lease of \(\$ 10,000\) on December 31, Year 6.

(6) The firm declared cash dividends during Year 6 of \(\$ 26,000\), of which \(\$ 10,000\) remains unpaid on December 31, Year 6. During Year 6, the firm paid \(\$ 8,000\) cash for dividends declared during Year 5.

(7) The firm classifies all marketable securities as available for sale. It purchased no marketable securities during Year 6 but sold marketable equity securities that had originally cost \(\$ 4,500\) for \(\$ 9,100\) cash in November, Year 6. The market values of marketable equity securities were \(\$ 4,000\) on December 31 , Year 5, and \(\$ 10,500\) on December 31, Year 6. These amounts were also the book values of the securities on these two dates.

(8) Investors in \(\$ 100,000\) face value of convertible bonds of Breda Enterprises Inc. converted them into 8,000 shares of the firm's \(\$ 12\)-par value common stock during Year 6. The common stock had a market value of \(\$ 15\) per share on the conversion date. Breda Enterprises Inc. had originally issued the bonds at a premium. Their book value on the date of the conversion was \(\$ 105,000\). The firm chose the generally accepted (alternative) accounting principle of recording the issuance of the common stock at market value and recognizing a loss of \(\$ 15,000\). The loss is not classified as an extraordinary item. The firm amortized \(\$ 1,500\) of the bond premium between January 1, Year 6, and the date of the conversion.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil