John Dyson is in business trading wholesale in consumer durables. He purchases from reputable suppliers and sells

Question:

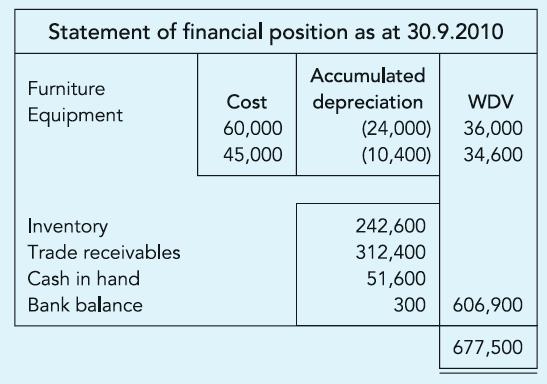

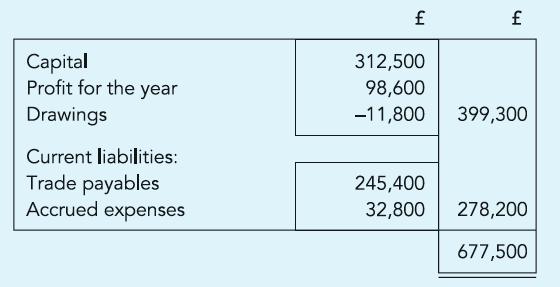

John Dyson is in business trading wholesale in consumer durables. He purchases from reputable suppliers and sells at a price calculated to yield a profit margin of 25% on cost. His accounts are in a state of disarray and you have been assigned the task of preparing the financial statements for the year ended 30 September 2011. You have been able to obtain from his auditors the Statement of financial position as at 30 September 2010 shown.

Your investigations reveal as follows:

(i) Unpaid invoices as at 30.9.2011 amount to £196,700.

(ii) Trade receivables as at 30.9.2011 were confirmed by circularising them at £168,500.

(iii) Non-current assets are depreciated at 20% per annum using reducing balance method.

(iv) Cost of inventory as at 30 September 2011 was £284,600.

(v) John always banks the whole of his takings, maintaining a float of only £300, and has summarised the payments made from this float as follows:

£12,400 paid to suppliers;

£9,600 paid for other expenses; and

£11,800 drawings by John.

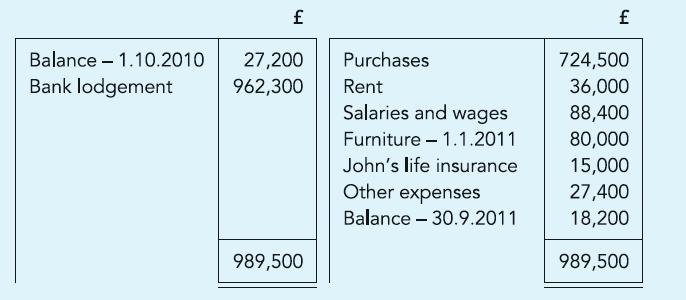

(vi) Bank statements for the year ended 30.9.2011 have been summarised as set out on the right. Deposits not cleared were £17,500 on 30.9.2010 and £24,400 a year later. A cheque for £46,800 drawn in favour of a supplier on 27 September 2011 was not presented to the bank for payment until a week later.

Required:

The Statement of income for the year ended 30 September 2011 and the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict