Journal entries to correct accounting errors. Give correcting entries for the following situations. In each case, the

Question:

Journal entries to correct accounting errors. Give correcting entries for the following situations. In each case, the firm uses the straight-line method of depreciation and clo.ses its books annually on December 3 1 . Recognize all gains and losses currently.

a. A firm purchased a computer for $3,000 on January 1, Year 3. It depreciated the computer at a rate of 25 percent of original cost per year. On June 30, Year 5. it sold the computer for $800 and acquired a new computer for $4,000. The bookkeeper made the following entry to record the transaction:

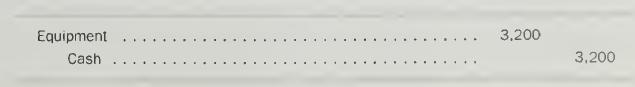

b. A firm purchased a used truck for $7.U0U. Its cost, when new. was $12,000. The bookkeeper made the following entry to record the purchase:

c. A firm purchased a testing mechanism on April 1, Year 6. for $1,200. It depreciated the testing mechanism at a 10 percent annual rate. A burglar stole the testing mechanism on June 30, Year 8. The firm had not insured against this theft. The bookkeeper made the following entry:

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil