Lambert and Mirza were in partnership without any agreement. They admitted Newton to partnership on 1 October

Question:

Lambert and Mirza were in partnership without any agreement. They admitted Newton to partnership on 1 October 2012. Profit of the partnership for the year ended 31 December 2012 was £714,000.

Determine each partner’s share of profit in each of the following independent scenarios:

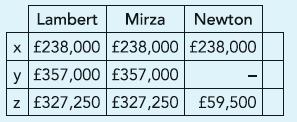

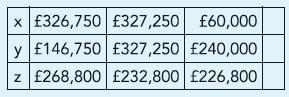

(a) Assuming that profit accrued consistently throughout the year

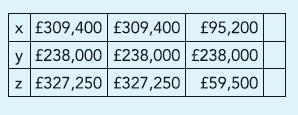

(b) If sales in each of the three months after admission of Newton was double that in the previous nine months

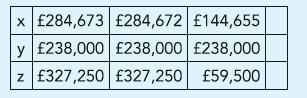

(c) If sales in the three months after admission of Newton was double that in the previous nine months and you are informed that when arriving at the profit of £714,000 for the year, distribution cost of £280,400 and administrative expenses of £989,100 have been written off

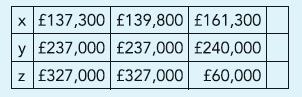

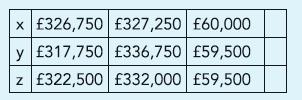

(d) Profits accrued consistently throughout the year but at admission, Newton’s share of partnership profit was guaranteed by the partnership at £240,000 per annum

(e) Profits accrued consistently throughout the year but at admission Newton’s share of partnership profit was guaranteed by Lambert at £240,000 per annum

(f) Profits accrued consistently throughout the year but at admission, Mirza was assured by Lambert that if Newton’s share of profit exceeds £200,000 per annum, Lambert will bear the whole of the excess

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict