Lion is a company producing medicinal drugs. At 1 October 2010 the following balances existed in the

Question:

Lion is a company producing medicinal drugs. At 1 October 2010 the following balances existed in the records:

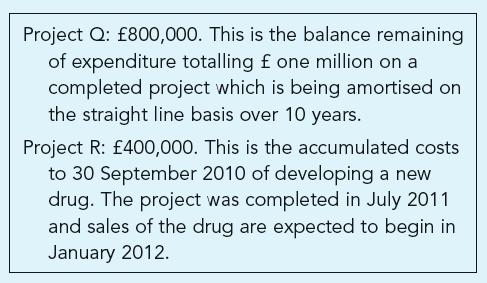

■ Deferred development expenditure £1,200,000. See details in the box.

■ Equipment used in research £300,000 (cost £500,000, depreciation to date £200,000).

During the year ended 30 September 2011 the following costs were incurred:

Project R: Costs to complete £250,000.

Project S: (a research project) £140,000.

Purchase of testing equipment for use in the research

Department £180,000.

Estimated useful life of equipment is five years, and full depreciation is charged in the year of acquisition.

Required:

(a) Calculate the figures to be included in Lion’s Statement of income for the year ended 30 September 2011, the Statement of financial position as at that date, and state the headings under which they will appear.

(b) Prepare disclosure notes required by IAS 38 Intangible assets (note on accounting policy is not required).

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict