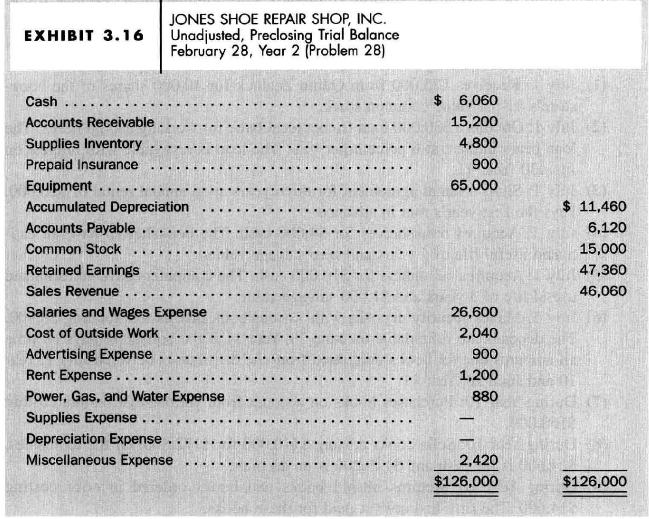

Preparation of T-account entries, adjusted trial balance, income statement, and balance sheet. The unadjusted, preclosing trial balance

Question:

Preparation of T-account entries, adjusted trial balance, income statement, and balance sheet. The unadjusted, preclosing trial balance of Jones Shoe Repair Shop, Inc., at February 28, Year 2, appears in Exhibit 3.16. The firm has not made adjusting

entries or closed its books since December 31, Year 1. A summary of the transactions during the month of March, Year 2, follows.

(1) Sales for cash total \(\$ 22,000\); sales on account total \(\$ 14,900\).

(2) Collections on account total \(\$ 18,200\).

(3) Purchases of outside work (repair work done by another shoe repair shop for Jones) total \(\$ 1,200\), on account.

(4) Purchases of supplies, on account, total \(\$ 3,700\).

(5) Payments on account total \(\$ 5,800\).

(6) Payments for March rent total \(\$ 1,000\).

(7) Payments for March salaries and wages total \(\$ 11,900\).

Adjusting entries required at the end of March relate to the following:

(8) Supplies used for the quarter total \(\$ 6,820\).

(9) Depreciation for the quarter totals \(\$ 2,820\).

(10) Bills received but not yet recorded or paid by the end of the month total as follows: advertising, \(\$ 400\); power, gas, and water, \(\$ 520\).

(11) Insurance expired for the quarter totals \(\$ 400\).

a. Open T-accounts and enter the trial balance amounts.

b. Record the transactions for the month of March and adjusting entries at the end of March in the T-accounts, opening additional T-accounts as needed. Cross-reference the entries using the numbers of the transactions above.

c. Prepare an adjusted, preclosing trial balance at March 31, Year 2, and an income statement for the three months ending March 31, Year 2.

d. Enter closing entries in the T-accounts using an Income Summary account.

e. Prepare a balance sheet as of March 31, Year 2.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil