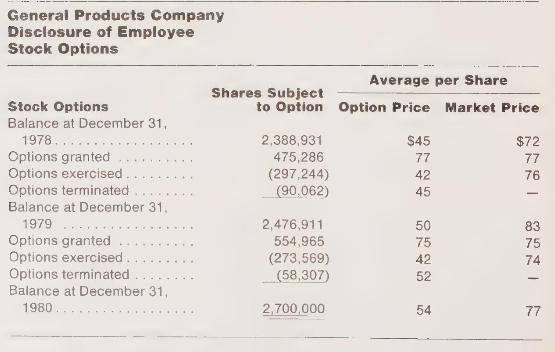

Refer to the schedule reproduced here, which shows employee stock option data for the General Products Company

Question:

Refer to the schedule reproduced here, which shows employee stock option data for the General Products Company (GP). At December 31, 1980, there were 2.7 million options outstanding to purchase shares at an average of \(\$ 54\) per share. Total stockholders' equity at December 31, 1980, was about \(\$ 2.5\) billion.

a If GP were to issue 2.7 million shares in a public offering at the market price per share on December 31, 1980, what would be the proceeds of the issue?

b If GP were to issue 2.7 million shares to employees who exercised all outstanding stock options, what would be the proceeds of the issue?

c Are GP's stockholders better off under a or under \(\mathbf{b}\) ?

d The text accompanying the stock option data in the GP annual report reads, in part, as follows:

Option price under these plans is the full market value of General Products common stock on date of grant. Therefore, participants in the plans do not benefit unless the stock's market price rises, thus benefiting all share owners. . . .

GP seems to be saying that stockholders are not harmed by these options, whereas your answers to parts \(\mathbf{a}\) and \(\mathbf{b}\) show stockholders are worse off when options are exercised than when shares are issued to the public. Attempt to reconcile GP's statement with your own analysis in parts a and \(\mathbf{b}\).

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney