Question:

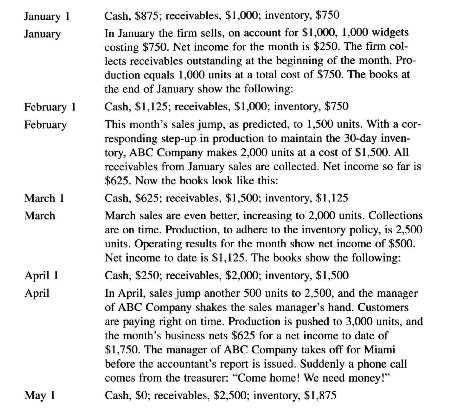

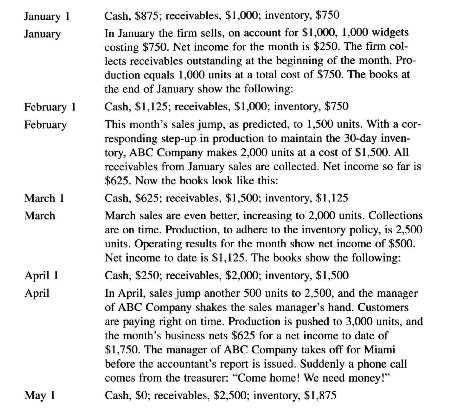

Relations between net income and cash flows. The ABC Company starts the year in fine shape. The firm makes widgets-just what the customer wants. It makes them for \(\$ 0.75\) each and sells them for \(\$ 1.00\). The ABC Company keeps an inventory equal to shipments of the past 30 days, pays its bills promptly, and collects cash from customers within 30 days after the sale. The sales manager predicts a steady increase in sales of 500 widgets each month beginning in February. It looks like a great year, and it begins that way.

a. Prepare an analysis that explains what happened to ABC Company. (Hint: Compute the amount of cash receipts and cash disbursements for each month during the period January 1 to May 1.)

b. How can a firm show increasing net income but a decreasing amount of cash?

c. What insights are provided by the problem about the need for all three financial statements-balance sheet, income statement, and statement of cash flows?

d. What actions would you suggest that ABC Company take to deal with its cash flow problem?

Transcribed Image Text:

January 1 January February 1 February March 1 March April 1 April May 1 Cash, $875; receivables, $1,000; inventory, $750 In January the firm sells, on account for $1,000, 1,000 widgets costing $750. Net income for the month is $250. The firm col- lects receivables outstanding at the beginning of the month. Pro- duction equals 1,000 units at a total cost of $750. The books at the end of January show the following: Cash, $1,125; receivables, $1,000; inventory, $750 This month's sales jump, as predicted, to 1,500 units. With a cor- responding step-up in production to maintain the 30-day inven- tory, ABC Company makes 2,000 units at a cost of $1,500. All receivables from January sales are collected. Net income so far is $625. Now the hooks look like this: Cash, $625; receivables, $1,500; inventory, $1,125 March sales are even better, increasing to 2,000 units. Collections are on time. Production, to adhere to the inventory policy, is 2,500 units. Operating results for the month show net income of $500. Net income to date is $1,125. The books show the following: Cash, $250); receivables, $2,000; inventory, $1,500 In April, sales jump another 500 units to 2,500, and the manager of ABC Company shakes the sales manager's hand. Customers are paying right on time. Production is pushed to 3,000 units, and the month's business nets $625 for a net income to date of $1,750. The manager of ABC Company takes off for Miami before the accountant's report is issued. Suddenly a phone call comes from the treasurer: "Come home! We need money!" Cash, $0); receivables, $2,500; inventory, $1,875