The chapter points out that two alternatives for treating discounts on merchandise purchases are often used in

Question:

The chapter points out that two alternatives for treating discounts on merchandise purchases are often used in practice: (1) the gross price method, which recognizes the amount of discounts taken on payments made during the period, without regard to the period of purchase, and (2) the net price method, which deducts all discounts made available from the gross purchase invoice prices at the time of purchases. This problem explains the two methods.

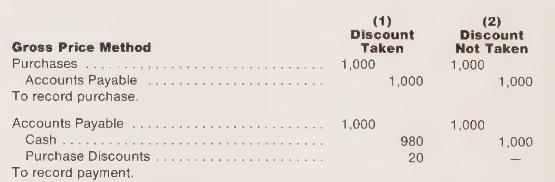

Alternative 1: Gross Price Method The gross price method of accounting for purchases records invoices at the gross price and accumulates the amount of discounts taken on payments made. Suppose that goods with a gross invoice price of \(\$ 1,000\) are purchased, 2/10, net \(/ 30\). (That is, a 2-percent discount from invoice price is offered if payment is made within 10 days and the full invoice price is due, in any case, within 30 days.) The entries to record the purchase and the payment (1) under the assumption that the payment is made in time to take the discount, and (2) under the assumption that the payment is too late to take advantage of the discount, are as follows:

The balance in the Purchase Discounts account is deducted from the balance in the Purchases account in calculating net purchases for a period. Such a deduction merely approximates the results achieved by treating purchase discounts as a reduction in purchase price at the time of purchase. It is only an approximation because the total adjustment includes discounts taken on payments made this period, without regard to the period of purchase.

An accurate adjustment would require eliminating the discounts taken related to purchases of previous periods while including the amount of discounts available at the end of the accounting period that are expected to be taken during the following period. This refinement in the treatment of purchase discounts is seldom employed in practice.

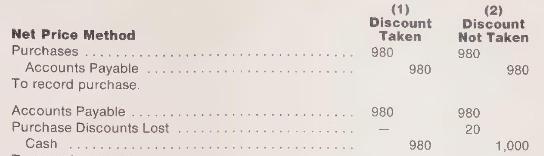

Alternative 2: Net Price Method In recording purchases, the purchase discount is deducted from the gross purchase price immediately upon receipt of the invoice, and the net invoice price is used in the entries. The example used previously of a \(\$ 1,000\) invoice price for goods subject to a 2-percent cash discount would be recorded as follows under the net price method:

The balance in the Purchase Discounts Lost account could be added to the cost of the merchandise purchased and, therefore, viewed as an additional component of goods available for sale. We believe, however, that discounts lost should be shown as a financial or general operating expense rather than as an addition to the cost of purchases, since lost discounts may indicate an inefficient office force or inadequate financing. In this text, we treat purchase discounts lost as an expense unless an explicit contrary statement is made a Attempt to decide which of these two alternatives is preferable and why. You might find working part \(\mathbf{b}\), below, helpful in making your decision.

b Prepare a journal form with two pairs of columns, one headed Net Price Method and the other headed Gross Price Method. Using this journal form, show summary entries for the following events in the history of Evans and Foster, furniture manufacturers.

(1) During the first year of operations, materials with a gross invoice price of \(\$ 60,000\) are purchased. All invoices are subject to a 2-percent cash discount if paid within 10 days.

(2) Payments to creditors during the year amount to \(\$ 53,000\), settling \(\$ 54,000\) of accounts payable at gross prices.

(3) Of the \(\$ 6,000\), gross, in unpaid accounts at the end of the year, the discount time has expired on one invoice amounting to \(\$ 400\). It is expected that all other discounts will be taken. This expectation is reflected in the year-end adjustment (4) During the first few days of the next period, all invoices are paid in accordance with expectations.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney