The following transactions of My Dollar stores occurred during 2010 and 2011: Requirement 1. Record the transactions

Question:

The following transactions of My Dollar stores occurred during 2010 and 2011:

Requirement 1. Record the transactions in the company’s journal. Explanations are not required.

Transcribed Image Text:

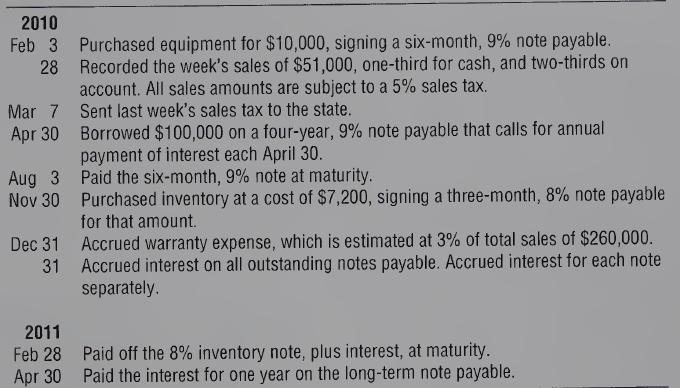

2010 Feb 3 28 Mar 7 Purchased equipment for $10,000, signing a six-month, 9% note payable. Recorded the week's sales of $51,000, one-third for cash, and two-thirds on account. All sales amounts are subject to a 5% sales tax. Sent last week's sales tax to the state. Apr 30 Borrowed $100,000 on a four-year, 9% note payable that calls for annual payment of interest each April 30. Aug 3 Nov 30 Paid the six-month, 9% note at maturity. Purchased inventory at a cost of $7,200, signing a three-month, 8% note payable for that amount. Dec 31 Accrued warranty expense, which is estimated at 3% of total sales of $260,000. Accrued interest on all outstanding notes payable. Accrued interest for each note separately. 2011 Feb 28 Paid off the 8% inventory note, plus interest, at maturity. Apr 30 Paid the interest for one year on the long-term note payable.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

Answered By

Abigael martinez

I have been a tutor for over 3 years and have had the opportunity to work with students of all ages and backgrounds. I have a strong belief that all students have the ability to learn and succeed if given the right tools and support. I am patient and adaptable, and I take the time to get to know each student's individual learning style in order to best support their needs. I am confident in my ability to help students improve their grades and reach their academic goals.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following transactions of My Dollar stores occurred during 2014 and 2015: 2014 Feb 3 Purchased equipment for $10,000, signing a six-month, 9% note payable. 28 Recorded the weeks sales of $51,000,...

-

The following transactions of Harmony Music Company occurred during 2010 and 2011: 2010 Mar 3 Purchased a piano (inventory) for $70,000, signing a six-month, 4% note payable. May 31 Borrowed $75,000...

-

simplify and factor the equation. 2cos^(2)x-1-7c osx+4=0 2cos^(2)x-7cosx+3=0 Combine like (2cosx-1)(cosx-3)=0 Factor. apply the zero product property.

-

1. Calculate the budgeted nights booked: Maximum capacity (30 rooms) * Number of days per year (365) * Expected occupancy rate (80%) = 8760 nights. 2. Calculate the tariff revenues: Budgeted nights...

-

A depreciable asset costs $10,000 and has an estimated salvage value of $1600 at the end of its 6-year depreciable life. Compute the depreciation schedule for this asset by both SOYD depreciation and...

-

Who is a process owner?

-

Consumer Reports posts reviews and ratings of a variety of products on its website. The following is a sample of 20 speaker systems and their ratings. The ratings are on a scale of 1 to 5, with 5...

-

Kayla Inc. operates a retail operation that purchases and sells home entertainment products. The company purchases all merchandise inventory on credit and uses a periodic inventory system. The...

-

Leyton Lumber Company has sales of $9 million per year, all on credit terms calling for payment within 30 days, and its accounts receivable are $1.8 million. Assume 365 days in year for your...

-

Jordan, Corp., completed the following transactions in 2010: Requirements 1. Complete the following amortization schedule for the first four mortgage payments on the \($100,000\) mortgage note,...

-

Pine City Company had the following balances as of December 31,2010: Requirement 1. Calculate Pine City Companys debt ratio as of December 31, 2010. Does it appear that Pine City Company is in a...

-

Complete and submit the following two documents: Copy and paste your Quarterly Decision Summary from the Interpretive Simulation program into a Microsoft Word or Excel document. Then upload this file...

-

Assume, further, that the acquisition was consummated on October 1, 2024, as described above. However, by the end of 2025, Ayayai was concerned that the fair values of one or both of the acquired...

-

You have been asked to prepare a brief presentation on a criminological topic or issue of interest to you. Go to the Bureau of Justice Statistics (BJS) Publications & Products Overview page (See link...

-

Sparta Fashions owns four clothing stores, where it sells a wide range of women's fashions, from casual attire to formal wear. In addition, it rents formal wear and gowns for special occasions. At...

-

Problem 2-26 (Static) Complete the balance sheet using cash flow data LO 2-2, 2-3, 2-5, 2-6 Following is a partially completed balance sheet for Epsico Incorporated at December 31, 2022, together...

-

Consider the following potential events that might have occurred to Global Conglomerate on December30, 2018. For eachone, indicate which line items inGlobal's balance sheet would be affected and by...

-

Simpson Glove Company has made the following sales projections for the next six months. All sales are credit sales. March .........$41,000 April......... 50,000 May......... 32,000 June............

-

Consider the combustion of methanol below. If 64 grams of methanol reacts with 160 grams of oxygen, what is the CHANGE in volume at STP. 2CH3OH(g) + 3O2(g) 2CO2(g) + 4H2O(1) The volume decreases by...

-

James Bond, Inc., owns 4,000,000 shares of xyz Corp Inc. On December 31, 2012, James distributed these shares as a dividend to its shareholders. This is an example of a Select one: a. property...

-

Question 3 a.) The more days sales in inventory the higher the inventory turnover.(True/False) b.) Unearned income is a liability.(True/False) c.) Deferred revenue is unearned.(True/False) d.)...

-

A company has sales of $715,400 and cost of goods sold of $286,400. Its gross profit equals

Study smarter with the SolutionInn App