The Humbolt Electric Company received a contract late in 1978 to build a small electricitygenerating unit. The

Question:

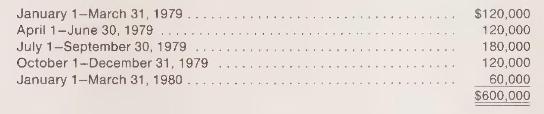

The Humbolt Electric Company received a contract late in 1978 to build a small electricitygenerating unit. The contract price was \(\$ 700,000\) and it was estimated that total costs would be \(\$ 600,000\). Estimated and actual construction time was 15 months and it was agreed that payments would be made by the purchaser as follows:

Estimated and actual costs of construction incurred by the Humbolt Electric Company were as follows:

The Humbolt Electric Company prepares financial statements quarterly at March 31, June 30

, and so forth.

Determine the amount of revenue, expense, and net income for each quarter under each of the following methods of revenue recognition:

a Production (percentage-of-completion) method.

b Sales (completed-contract) method.

c Cash collection (installment) method.

d Cash collection (cost-recovery-first) method.

e Which method do you feel provides the best measure of Humbolt's performance under this contract? Why?

f Under what circumstances would the methods not selected in part e provide a better measure of performance?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney