The purpose of this problem is to help you explore the relationship between replacement cost of goods

Question:

The purpose of this problem is to help you explore the relationship between replacement cost of goods sold and historical LIFO cost of goods sold. The text makes several points in this regard:

(1) LIFO cost of goods sold is generally larger in a periodic system than in a perpetual system.

(2) LIFO cost of goods sold for most companies is insignificantly different from replacement cost of goods sold using replacement costs as of the time of sale.

(3) Historical LIFO cost of goods sold in a periodic inventory system is likely to be larger (although not significantly) than the replacement cost of goods sold using replacement cost at the time of sale.

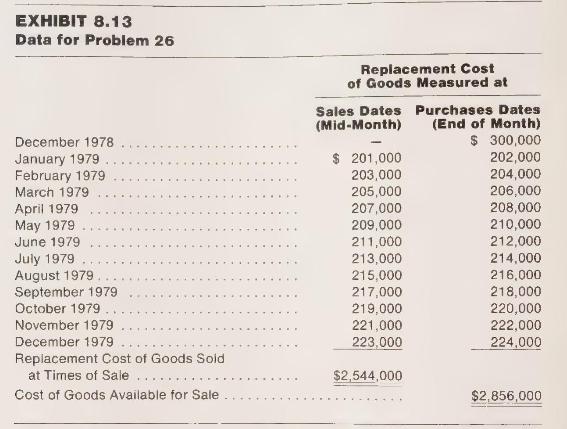

The accompanying data are hypothetical. They are constructed from ratios of an actual retailing firm selling grocery products. Sales revenue for the year is \(\$ 2,820,000\). All expenses (including income taxes) other than cost of goods sold are \(\$ 144,000\) for the year. Exhibit 8.13 shows cost of goods available for sale.

The costs of the grocery items for this company increase during the year at a steady rate of about 1 percent per month. The company starts the year with an inventory equal to \(1 \frac{1}{2}\) months' sales. These items were acquired at the end of December 1978 for \(\$ 300,000\). At the end of each month during 1979, the firm is assumed to acquire inventory in physical quantities equal to the next month's sales requirements. We assume that all sales occur at mid-month during each month and that all purchases occur at the end of a month to be sold during the next month. (These artificial assumptions capture the reality of a firm acquiring inventory on average \(\frac{1}{2}\) month before it is sold and inventory turnover rate of about eight times per year.) Identical physical quantities are purchased and sold each month.

Exhibit 8.13 shows the actual cost of the items purchased at the end of each month and the replacement cost of those items if they had been acquired at mid-month.

At the end of the year, ending physical inventory is equal in amount to \(1 \frac{1}{2}\) months' sales, which is the same as the physical quantity on hand at the start of the year.

a Compute LIFO historical cost of goods sold and net income for 1979 using a periodic inventory method.

b Compute LIFO historical cost of goods sold and net income for 1979 using a perpetual inventory method.

c Compute net income for 1979 using replacement cost of goods sold at the time of sale d What is the percentage difference between the largest and smallest cost-of-goods-sold figures computed in the preceding three parts?

e What is the percentage error in using LIFO cost of goods sold to approximate replacement cost of goods sold? (Compute percentage errors for both LIFO periodic and LIFO perpetual calculations.)

f Would you expect that most companies who use LIFO for tax purposes do so with a periodic inventory method or with a perpetual inventory method? Why?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney