This problem tries to make clear the difference between the impact on financial statements of the choice

Question:

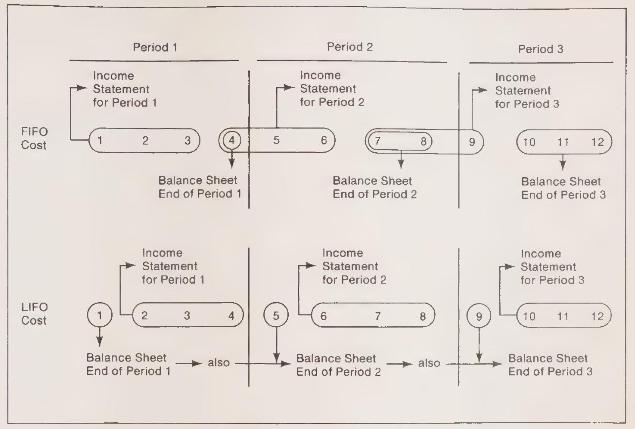

This problem tries to make clear the difference between the impact on financial statements of the choice between a FIFO and a LIFO flow assumption. Take 12 pieces of paper and mark each one with a number between 1 and 12 inclusive. Sort the pieces of paper into a pile with the numbers in consecutive order facing up, so that number 1 is on top and number 12 is on bottom. These 12 pieces of paper are to represent 12 identical units of merchandise purchased at prices increasing from \(\$ 1\) to \(\$ 12\). Assume that four of the units are purchased each period for three periods, that three units are sold each period, and that the periodic inventory method is used.

a Compute the cost of goods sold and ending inventory amounts for each of the three periods under a FIFO flow assumption.

b Compute the cost of goods sold and ending inventory amounts for each of the three periods under a LIFO flow assumption.

c Re-sort the 12 pieces of paper into decreasing order to represent declining prices for successive purchases. Compute the cost-of-goods-sold and ending inventory amounts for each of the three periods under a FIFO flow assumption.

d Repeat part c using a LIFO flow assumption.

e If you are not convinced that the following are all true statements, then repeat parts a-d until you are.

(1) In periods of rising prices and increasing physical inventories, FIFO implies higher reported income than does LIFO.

(2) In periods of declining prices and increasing physical inventories, LIFO implies higher reported income than does FIFO.

(3) Under FIFO, current prices are reported on the balance sheet and old prices are reported on the income statement.

(4) Under LIFO, current prices are reported on the income statement and very old prices are reported on the balance sheet.

(5) The difference between FIFO and LIFO balance sheet amounts for inventory at the end of each period after the first one is larger than the differences between FIFO and LIFO reported net income for each period after the first one.

f Assume that in period 4, only one unit (number 13) is purchased for \(\$ 13\), but three are sold. What additional "truth" can you deduce from comparing LIFO and FIFO cost of goods sold when physical quantities are declining?

g The LIFO portion of Figure 8.1 represents a periodic inventory method. In this part of the question, assume that in each period the first item is acquired before any sales occur. Then one item is sold; then the two items are purchased; then one more item is sold; then the last purchase is made and the last sale occurs. (If \(\mathrm{P}\) represents

purchase and \(\mathrm{S}\) represents sale, the events are PSPPSPS.) Draw a figure similar to those in Figure 8.1 to represent a LIFO cost-flow assumption coupled with a perpetual inventory system. Convince yourself that in times of rising prices the LIFO cost-of-goodssold figure with a periodic method exceeds LIFO cost of goods sold computed under a perpetual method.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney