The Trial Balance as at 30 June 2011 reports the Machinery account balance as 540,000 and the

Question:

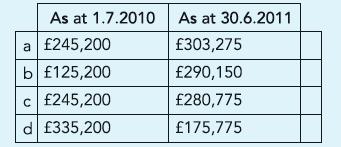

The Trial Balance as at 30 June 2011 reports the Machinery account balance as £540,000 and the balance in Accumulated depreciation (up to 30 June 2010) as £244,800. The balance in the Machinery account tincludes a machine acquired for £80,000 on 1 October 2010. A machine acquired for £120,000 on 1 July 2008 had been traded in for another with a list price of £90,000 on 1 March 2011. The trading-in of machinery has been accounted for correctly. Machinery is depreciated at 25% per annum using the reducing balance method. What is the carrying value of machinery (i.e. cost less depreciation) as at 1 July 2010 and as at 30 June 2011? No depreciation required in year of disposal.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict