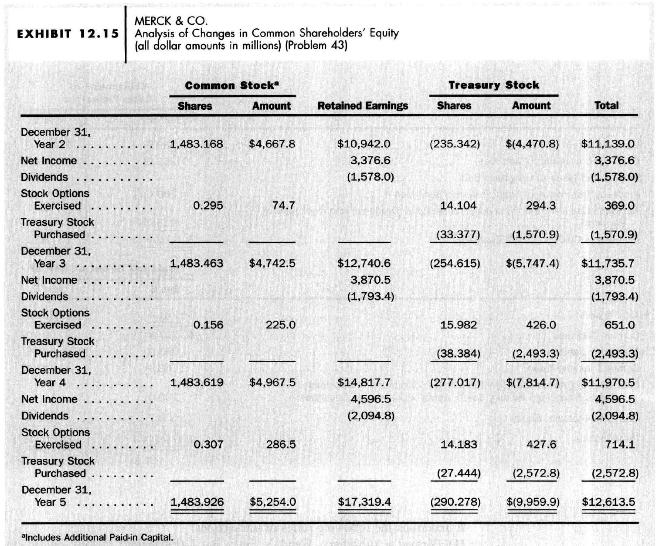

Treasury shares and their effects on performance ratios. Exhibit 12.15 presents the changes in common shareholders' equity

Question:

Treasury shares and their effects on performance ratios. Exhibit 12.15 presents the changes in common shareholders' equity of Merck for Year 3 through Year 5. Merck regularly purchases shares of its common stock and reissues them in connection with stock option plans. It will usually issue a small number of new common shares when it requires fractional shares to complete a stock option transaction. Earnings per common share were \(\$ 2.70\) in Year 3, \$3.20 in Year 4, and \$3.83 in Year 5.

a. Give the journal entries for Year 5 to record (1) the issue of common shares in connection with stock option plans, and (2) the purchase of treasury stock.

b. Compute the percentage change in net income and in earnings per share between Year 3 and Year 4 and between Year 4 and Year 5. Why do the percentage changes in earnings per share exceed the percentage changes in net income in both Year 4 and Year 5 ?

c. Compute the book value per outstanding common share at the end of Year 3, Year 4 , and Year 5 and the percentage change in book value per share between Year 3

and Year 4 and between Year 4 and Year 5. Why are the percentage changes in book value per common share less than the percentage changes in both net income and earnings per share?

d. Compute the rate of return on common shareholders' equity for Year 3, Year 4 and Year 5.

e. Do the treasury stock purchases appear to be motivated primarily by the need to satisfy commitments under stock option plans? Explain.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil