Verifine Used Auto Sales asked for your help in comparing the companys profit performance and financial position

Question:

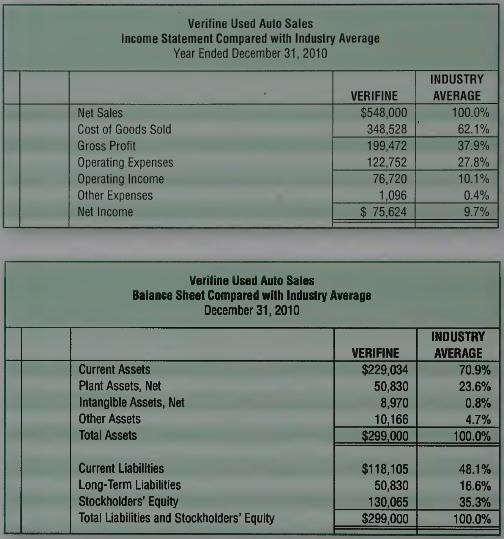

Verifine Used Auto Sales asked for your help in comparing the company’s profit performance and financial position with the average for the auto sales industry. The proprietor has given you the company’s income statement and balance sheet as well as the industry average data for retailers of used autos.

Requirements 1. Prepare a two-column, common-size income statement and a two-column, common-size balance sheet for Verifine Used Auto Sales. The first column of each statement should present Verifine Used Auto Sales’ common-size statement and the second column should show the industry averages.

2. For the profitability analysis, examine Verifine Used Auto Sales’

(a) ratio of gross profit to net sales,

(b) ratio of operating income to net sales, and

(c) ratio of net income to net sales. Compare these figures with the industry averages. Is Verifine Used Auto Sales’ profit performance better or worse than the industry average?

3. For the analysis of financial position, examine Verifine Used Auto Sales’

(a) ratio of current assets to total assets and

(b) ratio of stockholders’ equity to total assets. Compare these ratios with the industry averages. Is Verifine Used Auto Sales’ financial position better or worse than the industry average?

Step by Step Answer: