A fixed asset (a machine) was purchased by Adjourn plc on 1 July 20X1 at a cost

Question:

A fixed asset (a machine) was purchased by Adjourn plc on 1 July 20X1 at a cost of £25,000.

The company prepares its annual accounts to 31 March in each year.The policy of the company is to depreciate such assets at the rate of 15% straight line (with depreciation being charged pro rata on a time apportionment basis in the year of purchase).The company was granted capital allowances at 25%

per annum on the reducing balance method (such capital allowances are apportioned pro rata on a time apportionment basis in the year of purchase).

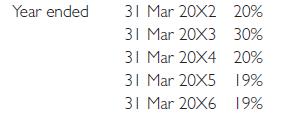

The rate of corporation tax has been as follows:

Required:

(a) Calculate the deferred tax provision using both the deferred method and the liability method.

(b) Explain why the liability method is considered by commentators to place the emphasis on the balance sheet, whereas the deferred method is considered to place the emphasis on the profit and loss account.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273708704

11th Edition

Authors: Barry Elliott, Jamie Elliott