Antonio Rossi set up a part-time business on 1 November 2004 buying and selling second-hand sports cars.

Question:

Antonio Rossi set up a part-time business on 1 November 2004 buying and selling second-hand sports cars. On 1 November 2004 he commenced business with $66,000 which he immediately used to purchase ten identical sports cars costing $6,600 each, paying in cash. On 1 May 2005 he sold seven of the sports cars for $8,800 each receiving the cash immediately. Antonio estimates that the net realisable value of each sports car remaining unsold was $8,640 as at 31 October 2005.

The replacement cost of similar sports cars was $6,800 as at 1 May 2005 and $7,000 as at 31 October 2005, and the value of a relevant general price index was 150 as at 1 November 2004, 155 as at 1 May 2005 and 159 as at 31 October 2005.

Antonio paid the proceeds from the sales on 1 May 2005 into a special bank account for the business and made no drawings and incurred no expenses over the year ending 31 October 2005.

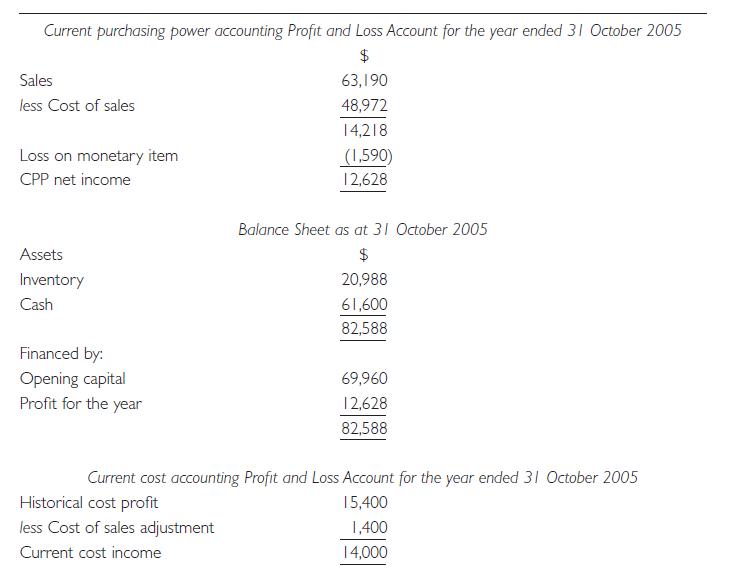

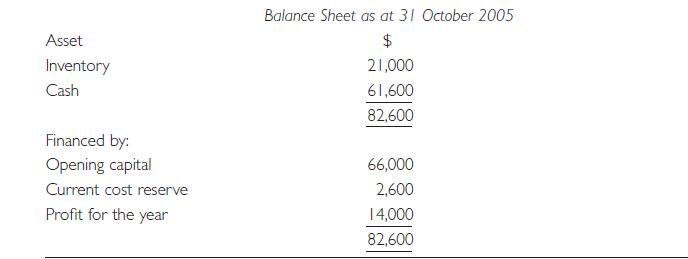

Antonio’s accountant has told him that there are different ways of calculating profit and financial position and has produced the following figures:

Required:

(a) Prepare Antonio’s historical cost profit and loss account for the year ended 31 October 2005 and his balance sheet as at 31 October 2005.

(b) (i) Explain how the figures for Sales and Cost of sales were calculated for the current purchasing power profit and loss account.You need not provide detailed calculations.

(ii) Explain what the ‘loss on monetary item’ means. In what circumstances would there be a profit on monetary items?

(c) (i) Explain how the ‘cost of sales adjustment’ was calculated and what it means.You need not provide detailed calculations.

(ii) Identify and explain the purpose of any three other adjustments which you might expect to see in a current cost profit and loss account prepared in this way.

(d) State, giving your reasons, which of the three bases gives the best measure of Antonio’s financial performance and financial position.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273708704

11th Edition

Authors: Barry Elliott, Jamie Elliott