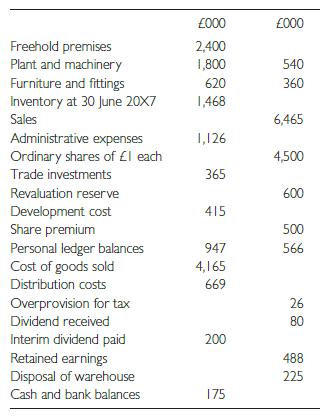

Phoenix plc trial balance at 30 June 20X7 was as follows: The following information is available: 1

Question:

Phoenix plc trial balance at 30 June 20X7 was as follows:

The following information is available:

1 Freehold premises acquired for £1.8 million were revalued in 20X4, recognising a gain of £600,000. These include a warehouse, which cost £120,000, was revalued at £150,000 and was sold in June 20X7 for £225,000. Phoenix does not depreciate freehold premises.

2 Phoenix wishes to repor t Plant and Machiner y at open market value which is estimated to be £1,960,000 on 1 July 20X6.

3 Company policy is to depreciate its assets on the straight-line method at annual rates as follows:

Plant and machiner y 10%

Furniture and fittings 5%

4 Until this year the company’s policy has been to capitalise development costs, to the extent permitted by relevant accounting standards. The company must now write off the development costs, including £124,000 incurred in the year, as the project no longer meets the capitalisation criteria.

5 During the year the company has issued one million shares of £1 at £1.20 each.

6 Included within administrative expenses are the following:

Staff salar y (including £125,000 to directors) £468,000 Directors’ fees £96,000 Audit fees and expenses £86,000 7 Income tax for the year is estimated at £122,000.

8 Directors propose a final dividend of 4p per share declared and an obligation, but not paid at the year-end.

Required:

(a) In respect of the year ended 30 June 20X7:

The income statement.

(b) The balance sheet as at 30 June 20X7.

(c) The statement of movement of property, plant and equipment.

(d) The statement of recognised income and expense.

(e) Explain how the financial statements prepared above would be changed to comply with the Phase A changes proposed for a revised IFRS 1.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273712312

12th Edition

Authors: Barry Elliott, Jamie Elliott