Raffles Ltd trades as a wine wholesaler with a large warehouse in Asia. The trainee accountant at

Question:

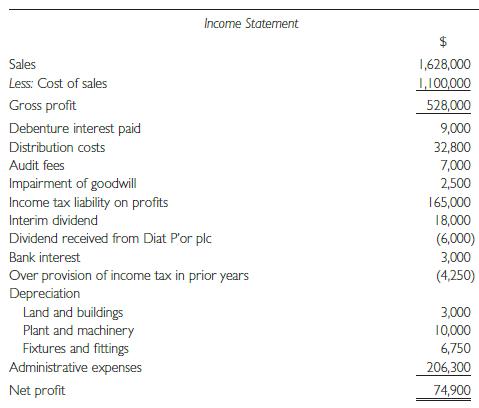

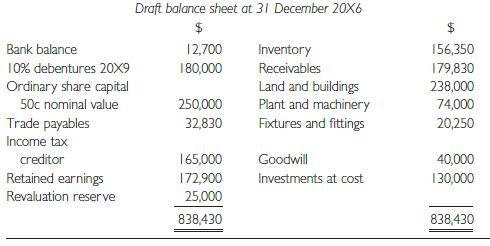

Raffles Ltd trades as a wine wholesaler with a large warehouse in Asia. The trainee accountant at Raffles Ltd has produced the following draft accounts for the year ended 31 December 20X6.

The following information is relevant:

1 The directors maintain that the investments in Diat P’or plc will be held by the company on a continuing basis and that the current market value of the investments at the balance sheet date was $135,000. However, since the balance sheet date there has been a substantial fall in market prices and these investments are now valued at $90,000.

2 The authorised share capital of Raffles Ltd is 600,000 ordinar y shares.

3 During the year the company paid shareholders the proposed 20X5 final dividend of $30,000.

This transaction has already been recorded in the accounts.

4 The company incurred $150,000 in restructuring costs during the year. These have been debited to the administrative expenses account. The trainee accountant subsequently informs you that tax relief of $45,000 will be given on these costs and that this relief has not yet been accounted for in the records.

5 The company employs an average of ten staff, 60% of whom work in the wine purchasing and impor ting depar tment, 30% in the distribution depar tment and the remainder in the accounts depar tment. Staff costs total $75,000.

6 The company has three directors. The managing director earns $18,000 while the purchasing and distribution directors earn $14,000 each. In addition the directors receive bonuses and pensions of $1,800 each. All staff costs have been debited to the income statement.

7 The directors propose to decrease the bad debt provision by $1,500 as a result of the improved credit control in the company in recent months.

8 Depreciation policy is as follows:

Land and buildings: No depreciation on land. Buildings are depreciated over 25 years on a straight-line basis. This is to be charged to cost of sales.

Plant and machiner y: 10% on cost, charge to cost of sales Fixtures and fittings: 25% reducing balance, charge to administration.

9 The directors have provided information on a potential lawsuit. A customer is suing them for allegedly tampering with the impor ted wine by injecting an illegal substance to improve the colour of the wine. The managing director informs you that this lawsuit is just ‘sour grapes’ by a jealous customer and provides evidence from the company solicitor which indicates that there is only a small possibility that the claim for $8,000 will succeed.

10 Purchased goodwill was acquired in 20X3 for $50,000. The annual impairment test revealed an impairment of $2,500 in the current year.

11 Plant and machinery of $80,000 was purchased during the year to add to the $20,000 plant already owned. Fixtures and fittings acquired two years ago with a net book value of $13,500 were disposed of. Accumulated depreciation of fixtures and fittings at 1 Januar y 20X6 was $37,500.

12 Land was revalued by $25,000 by Messrs Moneybags, Char tered Sur veyors, on an open market value basis, to $175,000. The revaluation surplus was credited to the revaluation reser ve. There is no change in the value of the buildings.

13 Gross profit is stated after charging $15,000 relating to obsolete cases of wine that have ‘gone off ’.

Since that time an offer has been received by the company for its obsolete wine stock of $8,000, provided the company does additional vinification on the wine at a cost of $2,000 to bring it up to the buyer’s requirements. A cash discount of 5% is allowed for early settlement and it is anticipated that the buyer will take advantage of this discount.

14 Costs of $10,000 relating to special plant and machinery have been included in cost of sales in error. This was not spotted until after the production of the draft accounts.

Required:

(a) Prepare an income statement for the year ended 31 December 20X6 and a balance sheet at that date for presentation to the members of Raffles Ltd in accordance with relevant accounting standards.

(b) Produce detailed notes to the income statement and balance sheet of Raffles Ltd for the year ended 31 December 20X6.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273712312

12th Edition

Authors: Barry Elliott, Jamie Elliott