Raiders plc prepares accounts annually to 31 March.The following figures, prepared on a conventional historical cost basis,

Question:

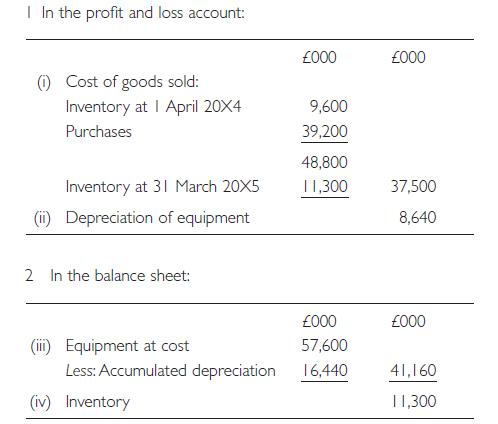

Raiders plc prepares accounts annually to 31 March.The following figures, prepared on a conventional historical cost basis, are included in the company’s accounts to 31 March 20X5.

The inventory held on 31 March 20X4 and 31 March 20X5 was in each case purchased evenly during the last six months of the company’s accounting year.

Equipment is depreciated at a rate of 15% per annum, using the straight-line method. Equipment owned on 31 March 20X5 was purchased as follows: on 1 April 20X2 at a cost of £16 million;

on 1 April 20X3 at a cost of £20 million; and on 1 April 20X4 at a cost of £21.6 million.

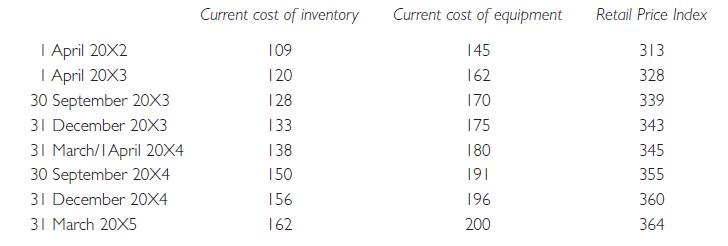

The following indices are available:

Required:

(a) Calculate the following current cost accounting figures:

(i) The cost of goods sold of Raiders plc for the year ended 31 March 20X5.

(ii) The balance sheet value of inventory at 31 March 20X5.

(iii) The equipment depreciation charge for the year ended 31 March 20X5.

(iv) The net balance sheet value of equipment at 31 March 20X5.

(b) Discuss the extent to which the figures you have calculated in

(a) above (together with figures calculated on a similar basis for earlier years) provide information over and above that provided by the conventional historical cost income statement and balance sheet figures.

(c) Outline the main reasons why the standard setters have experienced so much difficulty in their attempts to develop an accounting standard on accounting for changing prices.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273708704

11th Edition

Authors: Barry Elliott, Jamie Elliott