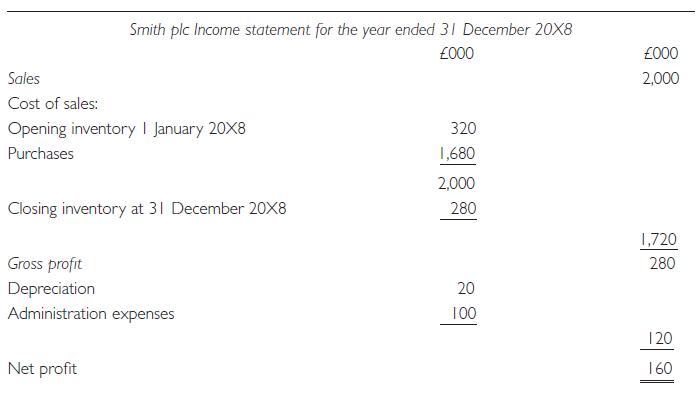

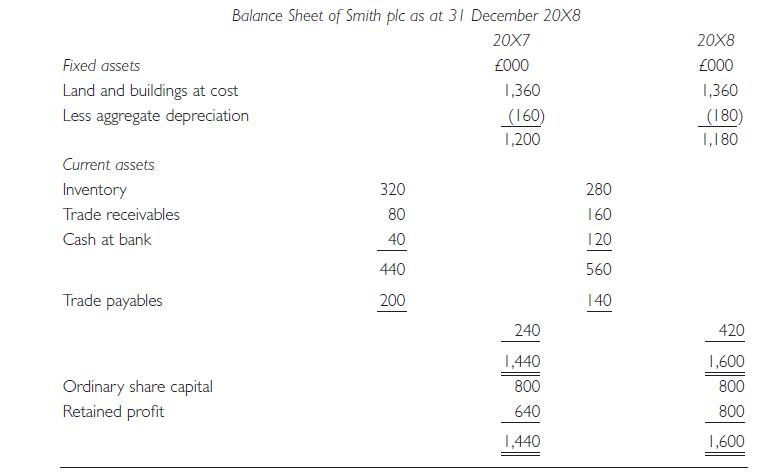

The historical cost accounts of Smith plc are as follows: 1 Land and buildings were acquired in

Question:

The historical cost accounts of Smith plc are as follows:

1 Land and buildings were acquired in 20X0 with the buildings component costing £800,000 and depreciated over 40 years.

2 Share capital was issued in 20X0.

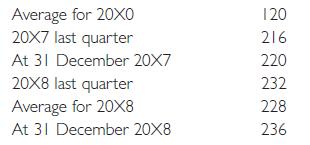

3 Closing inventories were acquired in the last quarter of the year.

4 RPI numbers were:

Required:

(i) Explain the basic concept of the CPP accounting system.

(ii) Prepare CPP accounts for Smith plc for the year ended 20X8.

The following steps will assist in preparing the CPP accounts:

(a) Restate the income statement for the current year in terms of £CPP at the year-end.

(b) Restate the closing balance sheet in £CPP at year-end, but excluding monetary items, i.e.

trade receivables, trade payables, cash at bank.

(c) Restate the opening balance sheet in £CPP at year-end, but including monetary items, i.e.

trade receivables, trade payables and cash at bank, and showing equity as the balancing figure.

(d) Compare the opening and closing equity figures derived in

(b) and

(c) above to arrive at the total profit/loss for the year in CPP terms. Compare this figure with the CPP profit calculated in

(a) above to determine the monetary gain or monetary loss.

(e) Reconcile monetary gains/loss in

(d) with the increase/decrease in net monetary items during the year expressed in £CPP compared with the increase/decrease expressed in £HC.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273708704

11th Edition

Authors: Barry Elliott, Jamie Elliott