Springtime Ltd is a UK trading company buying and selling as wholesalers fashionable summer clothes. The following

Question:

Springtime Ltd is a UK trading company buying and selling as wholesalers fashionable summer clothes.

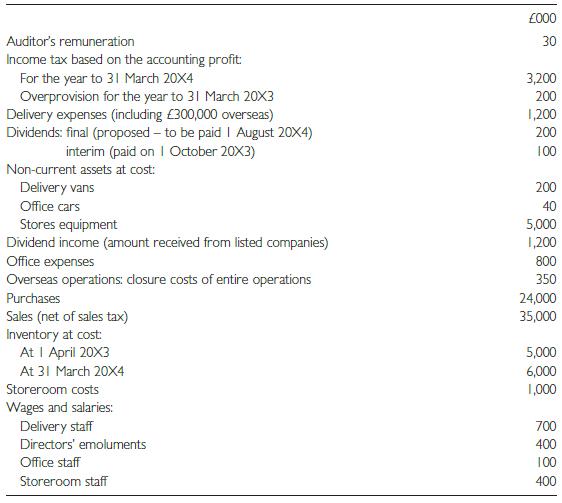

The following balances have been extracted from the books as at 31 March 20X4:

Notes:

1 Depreciation is provided at the following annual rates on a straight-line basis: deliver y vans 20%;

office cars 25%; stores 1%.

2 The following taxation rates may be assumed: corporate income tax 35%; personal income tax 25%.

3 The dividend income arises from investments held in non-current investments.

4 It has been decided to transfer an amount of £150,000 to the deferred taxation account.

5 The overseas operations consisted of expor ts. In 20X3/X4 these amounted to £5,000,000 (sales)

with purchases of £4,000,000. Related costs included £100,000 in storeroom staff and £15,000 for office staff.

6 Directors’ emoluments include:

Chairperson 100,000 Managing director 125,000 Finance director 75,000 Sales director 75,000 Expor t director 25,000 (resigned 31 December 20X3)

£400,000 Required:

(a) Produce an income statement suitable for publication and complying as far as possible with generally accepted accounting practice.

(b) Comment on how IFRS 5 has improved the quality of information available to users of accounts.

(c) Give two reasons why information contained in the accounting policies notes is of importance to users of accounts.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273712312

12th Edition

Authors: Barry Elliott, Jamie Elliott