The directors of Chekani pic, a large listed company, are engaged in a policy of expansion. Accordingly,

Question:

The directors of Chekani pic, a large listed company, are engaged in a policy of expansion. Accordingly, they have approached the directors of Meela Ltd, an unlisted company of substantial size, in connection with a proposed purchase of Meela Ltd.

The directors of Meela Ltd have indicated that the shareholders of Meela Ltd would prefer the form of consideration for the purchase of their shares to be in cash and you are informed that this is acceptable to the prospective purchasing company, Chekani pic.

The directors of Meela Ltd have now been asked to state the price at which the shareholders of Meela Ltd would be prepared to sell their shares to Chekani pic. As a member of a firm of independent accountants, you have been engaged as a consultant to advise the directors of Meela Ltd in this regard.

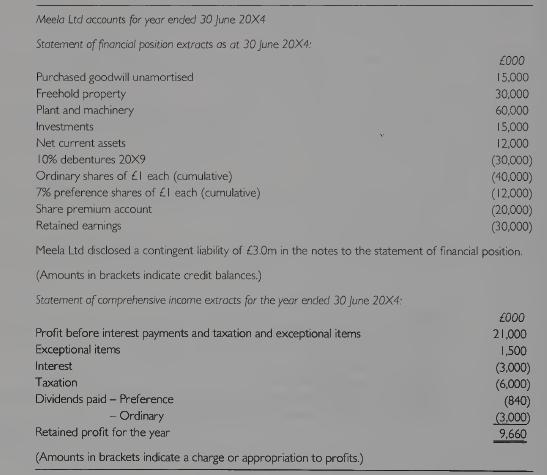

In order that you may be able to do so, the following details, extracted from the most recent financial statements of Meela, have been made available to you.

The following information is also supplied:

(i) Profit before interest and tax for the year ended 30 June 20X3 was £24.2 million and for the year ended 30 June 20X2 it was £30.3 million.

(ii) Assume tax at 30%.

(iii) Exceptional items in 20X4 relate to the profit on disposal of an investment in a related company. The related company contributed to profit before interest as follows:

To 30 June 20X4 £0 To 30 June 20X3 £200,000 To 30 June 20X2 £300,000 (iv) The preference share capital can be sold independently, and a buyer has already been found. The agreed purchase price is 90p per share, (v) Chekani pic has agreed to purchase the debentures of Meela Ltd at a price of £110 for each £100 debenture.

(vi) The current rental value of the freehold property is £4.5 million per annum and a buyer is available on the basis of achieving an 896 return on their investment.

(vii) The investments of Meela Ltd have a current market value of £22.5 million.

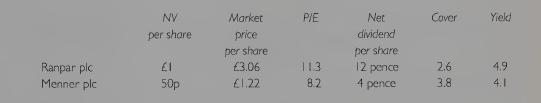

(viii) Meela Ltd is engaged in operations substantially different from those of Chekani pic. The most recent financial data relating to two listed companies that are engaged in operations similar to those of Meela Ltd are:

Required:

Write a report, of approximately 2,000 words, to the directors of Meela Ltd, covering the following:

(a) Advise them of the alternative methods used for valuing unquoted shares and explain some of the issues involved in the choice of method.

(b) Explain the alternative valuations that could be placed on the ordinary shares of Meela Ltd.

(c) Recommend an appropriate strategy for the board of Meela Ltd to adopt in its negotiations with Chekani pic.

Include, as appendices to your report, supporting schedules showing how the valuations were calculated.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273778172

16th Edition

Authors: Mr Barry Elliott, Jamie Elliott