The following are extracts from the financial statements of Heidelberger Druckmaschinen AG showing the accounting policy and

Question:

The following are extracts from the financial statements of Heidelberger Druckmaschinen AG showing the accounting policy and detailed notes regarding the provision of pensions according to IAS 19. As can be seen the disclosures are quite complex but they attempt to give a sensible balance sheet and income statements position.

Accounting policy disclosure Provisions for pensions and similar obligations comprise both the provision obligations of the Group under defined benefit plans and defined contribution plans. Pension obligations are determined according to the projected unit credit method (IAS 19) for defined benefit plans.

Actuarial expert opinions are obtained annually in this connection. Calculations are based on an assumed trend of 3.5% (previous year: 2.5%) for the growth in pensions, and a discount rate of 6.0% (previous year: 6.0%).The probability of death is determined according to Heubec’s current mortality tables as well as comparable foreign mortality tables.

In the case of defined contribution plans (for example, direct insurance policies), compulsory contributions are offset directly as an expense. No provisions for pension obligations are formed, as in these cases our Company does not have any liability over and above its liability to make premium payments.

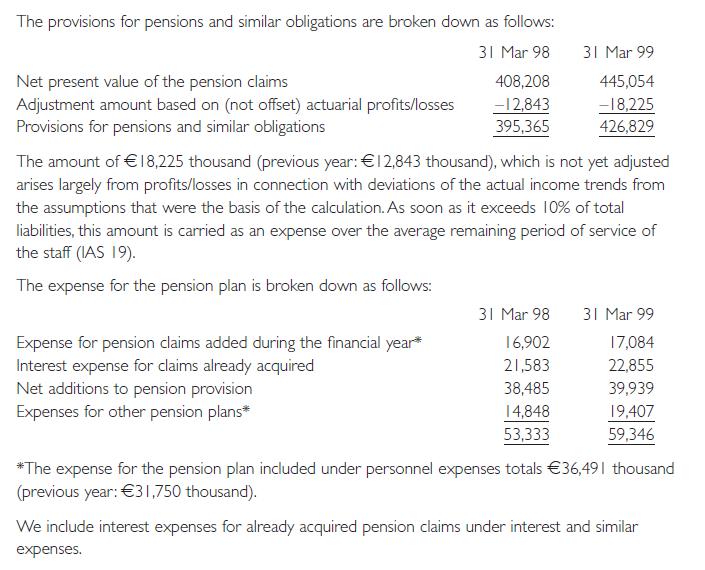

Provisions for pensions and similar obligations (Note 15 in the financial statements)

We maintain benefit programs for the majority of employees for the period following their retirement – either a direct program or one financed by payments of premiums to private institutions.The level of benefits payments depends on the conditions in particular countries.The amounts are generally based on the term of employment and the salary of the employees.The liabilities include both those arising from current pensions as well as vested pension rights for pensions payable in the future.The pension payments expected following the beginning of benefit payment are accrued over the entire service time of the employee.

Required:

(a) Explain the projected unit credit method for determining pension obligations for defined benefit plans.

(b) Why does the company need to use a discount rate?

(c) Explain the reference to the 10% corridor.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273708704

11th Edition

Authors: Barry Elliott, Jamie Elliott