Accrual-Basis Income Sport Company has been expanding rapidly over the past five years. Because it is privately

Question:

Accrual-Basis Income Sport Company has been expanding rapidly over the past five years. Because it is privately owned and has not needed to borrow any large sums of money, Sport has prepared its financial statements on a cash basis. It is now considering selling some of its shares to outside investors and needs to prepare accrual-based financial statements. The 2000 income statement for Sport company prepared on a cash basis resulted in reported net income of

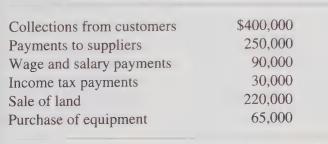

$185,000, consisting of the following amounts:

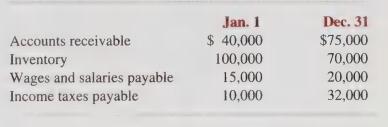

Had Sport used accrual accounting, its balance sheet accounts would have included the following:

The equipment purchased by Sport Company was delivered and payment made on December 31, 2000. Sport also sold the land on that date. The land had been purchased for $235,000 several years earlier. An analysis of fixed assets indicates that Sport Company would have recorded $24,000 of depreciation expense for 2000 on an accrual-accounting basis. Also during 2000, Sport Company was forced to scrap $46,000 of equipment that was destroyed when an earthen dam built in 1946 collapsed and water entered the plant. Fortunately, the equipment was insured, and Sport Company has reached an agreement with the insurance company. Payment of $90,000 will be received in January 2001.

a. Prepare an income statement for Sport Company for 2000 on an accrual-accounting basis.

b. What are the major changes in net income computed under the accrual basis?

c. Is cash-basis income a good measure of Sport’s operations for 2000? Explain.

d. A potential investor in Sport Company is a friend; would you recommend she invest in the company? Explain.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith