Asset Acquisitions String Music Co. decided to expand its product line to include banjos and harmonicas. Rather

Question:

Asset Acquisitions String Music Co. decided to expand its product line to include banjos and harmonicas.

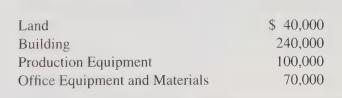

Rather than establish its own production facility, String Music Co. purchased the net assets of Discord Corporation for $360,000. Before making the purchase, String Music had appraisals made of Discord’s operating assets and business operations. The appraisals were as follows:

The appraisers also provided the following estimates of the remaining economic lives of these assets: buildings, 30 years, production equipment, 10 years; office equipment, 14 years;

and goodwill or other intangible assets, 15 years. As part of the purchase agreement, String Music also agreed to take responsibility for $150,000 of debt on the machinery and equipment.

The financial vice president of String Music Co. was in charge of the acquisition and thought String Music would get quite a bargain by paying $360,000. The replacement cost for a new building was estimated at $375,000, the cost of buying new production and office equipment would be $250,000, and he estimates that it would take another $200,000 beyond the cost of the assets to develop customer contacts and gain an acceptable level of product recognition. This is a total of $825,000. The financial vice president therefore favors recording the assets at $825,000.

a. Is it appropriate to recognize all, or any part, of the $825,000 total suggested by the financial vice president?

Explain.

b. If String Music pays $360,000 cash to acquire Discord, determine the amount it should assign to each of the assets and prepare the entry needed to record the purchase.

c. Assuming Discord reports sales of $400,000 and cost of inventory sold of $280,000 in the period following the acquisition, what amount of income will the purchase of Discord add to the earnings reported by String for the year?

d. String earns a gross margin of 45 percent on sales by its other operating divisions and a 10 percent return on total assets. How does the acquisition of Discord compare?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith