Consolidated Balance Sheet Down Corporation purchased 100 percent ownership of Topp Company for $80,000 and 100 percent

Question:

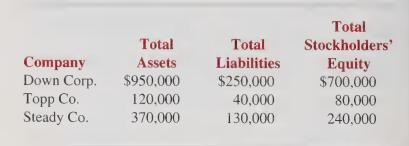

Consolidated Balance Sheet Down Corporation purchased 100 percent ownership of Topp Company for

$80,000 and 100 percent ownership of Steady Company for

$240,000 on January 1, 2000. Immediately after the purchases the companies reported the following amounts:

If a consolidated balance sheet is prepared immediately after ownership of the two companies is purchased:

a. What amount of total assets will be reported?

b. What amount of total liabilities will be reported?

c. What amount of total stockholders’ equity will be reported?

d. Why is it necessary to eliminate the balance in Down’s investment account in each of the two companies when a consolidated balance sheet is prepared?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith