Transfers between Companies Long Corporation produces and sells a broad line of recreational equipment. Each of the

Question:

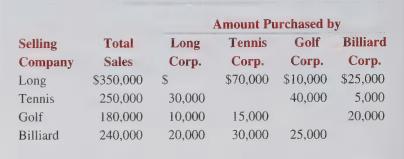

Transfers between Companies Long Corporation produces and sells a broad line of recreational equipment. Each of the major equipment lines is produced by a separate wholly-owned subsidiary, and there are significant intercorporate sales. In 2001, sales reported by Long Corporation and its subsidiaries were as follows:

Required:

a. What is the total amount of sales by Tennis Corporation to unrelated parties?

b. What is the total amount of sales that would be reported in the consolidated income statement for Long Corporation and its subsidiaries?

c. Why is it important that intercorporate sales be eliminated when preparing a consolidated income statement?

d. What are some of the ratios that would be misstated if intercompany sales were not eliminated when preparing the consolidated income statement?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith