Consolidated Income Statement Reich Manufacturing purchased all of the stock of Smith Supply Company on January 1,

Question:

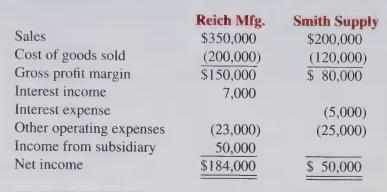

Consolidated Income Statement Reich Manufacturing purchased all of the stock of Smith Supply Company on January 1, 1995. For the year ended December 31, 2000, the companies reported the following income statement data:

During 2000, Reich sold to Smith Supply at cost goods for which it had paid $60,000. Also, Smith Supply had borrowed money from Reich during the year; the full loan had been repaid by the end of the year, along with $4,000 of interest.

a. Prepare a consolidated income statement for Reich Manufacturing and its subsidiary for the year ended December 31, 2000.

b. Why must the effects of intercompany ownership and intercompany transactions be eliminated when preparing the consolidated income statement?

c. What would the gross profit and gross margin percentage have been if the effects of the intercompany sale were not eliminated? By how much do the gross profit and gross margin percentage change when the intercorporate sale of inventory is eliminated?

d. Compute the times interest earned ratio for the consolidated entity. How would this have been different if the appropriate eliminations were not made?

e. How useful are the consolidated financial statements to the creditors of Smith Supply Company? Explain. Would your answer be different if Reich agreed to guarantee Smith Supply’s debt (pay the debt if Smith Supply defaults)? Why?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith