Ethics or Measurement? The Charger Company distributes automobile replacement parts to repair shops. Paul Charger, the owner

Question:

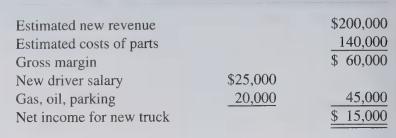

Ethics or Measurement? The Charger Company distributes automobile replacement parts to repair shops. Paul Charger, the owner and a close friend, wants to expand the business and is applying for a bank loan to purchase a new delivery truck. He will also hire one new driver. Paul plans to ask for a loan of $40,000, and he will buy a truck at a cost of $60,000. The bank told Paul that he needs a projected income statement that will show the outcome of the expansion proposal. Paul has asked you to help. He gives you the following draft of an annual income statement projection for the expanded business:

Paul says the cash-flow projection looks good. He can make the principal and interest payments on the loan, which will be $10,000 in the first year, and he will still make a little income. The bank should be happy because he will be profitable and he can repay the loan.

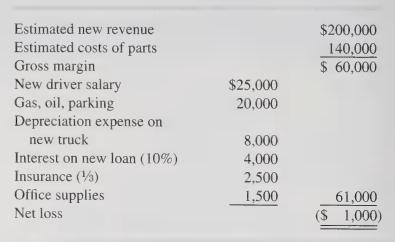

You are not so sure. When you look at Paul’s projected income statement, there is no depreciation expense on the new delivery truck, no interest expense for the bank loan, no insurance expense, and no expense for general office supplies. You know that Paul will need insurance and that he will use more office supplies. When you ask Paul about these items, he telis you that he does not take depreciation expense because when the truck is worn out he will replace it the same way he is buying this new truck. There is no insurance expense because he bought a three-year policy two years ago and paid for all of it at that time. It will cover the new truck.

Also, he “got a deal” on office supplies and he bought enough to last several years. You obtain additional information from Paul and prepare the following projected annual income statement for his expansion:

You run through a brief explanation of matching and adjusting entries for Paul. He says you may be right, but he didn’t include those items the last time he got a loan, and he won’t take your income statement to the bank because this time they won’t give him a loan if he projects a loss. Who is right, you or Paul? What should you do now? What would you ex- pect the banker to do in this case? Is Paul’s action unethical?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith