Evaluating Cash Flow Information An analysis of financial statement data for Grapp Company and Stomp Corporation resulted

Question:

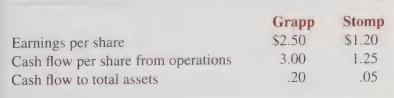

Evaluating Cash Flow Information An analysis of financial statement data for Grapp Company and Stomp Corporation resulted in the following ratio information:

a. What is likely to cause the amount reported as cash flow per share to be greater than the amount reported as earnings per share?

b. Is the amount reported as earnings per share or cash flow per share more likely to be affected by a delay in paying suppliers? Explain.

c. Which of the two companies appears to be in a better position to pay a cash dividend at the end of the current accounting period? Explain.

d. Why is the ratio of cash flow to total assets computed using the cash flow from operations rather than the cash flow from all sources? How might use of the net cash flows from all sources mislead investors?

e. Which of the two companies appears to be in a better position to replace its operating assets? Explain.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith