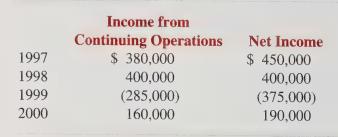

Evaluating Income Buzzer Corporation reported the following operating income and net income amounts: The income from continuing

Question:

Evaluating Income Buzzer Corporation reported the following operating income and net income amounts:

The income from continuing operations reported by Buzzer includes operating income and other income and expenses. Included in the 1999 loss from continuing operations was a $150,000 write down for an anticipated loss on inventory. Although inventory prices had not dropped, the emergence of new products on the market increased the possibility that the resale value of the inventory would decline. All of the inventory held at the end of 1999 was sold in 2000 at normal profit margins.

Included in 1997 net income was a $70,000 gain on bond retirement, which under generally accepted accounting principles must be reported as an extraordinary item. A $90,000 charge for overtime worked by employees in 1998, but recorded as an expense and paid in 1999, also was treated as an extraordinary item. A change in accounting principle in 2000 increased income by $30,000. Because Buzzer had excess cash on hand on January 1, 1999, it paid $72,000 for three years’ equipment rental and recorded rent expense for the full amount. Income from continuing operations for 2000 also included a $14,000 gain on the sale of land to another company.

Upon receiving a copy of the reported operating results of the company for the four-year period, one of the new members of the board of directors of Buzzer Corporation demanded that the company recompute reported income for 1999 and 2000. He was especially concerned that the management of Buzzer used an approach called the “big bath,”

under which companies write off excessive amounts to expense in years when they will already be reporting a loss.

This then makes reported operating results in subsequent years appear more favorable than they should.

a. What amounts should Buzzer Corporation have reported as income from continuing operations and net income for each of the four years? Were Buzzer’s operations profitable in 2000? Explain.

b. Would you agree that the big bath approach was used by the management of Buzzer Corporation? Explain.

c. How would it be possible for management to adjust the amounts spent for other items such as advertising and publicity to shift reported income from one period to another? In general, would this seem to be a wise strategy for management to pursue? Why?

d. Would the use of cash-basis net income rather than the accrual basis used by Buzzer Corporation increase or decrease the possibility of management being able to influence the amount of income reported in a particular period? Explain.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith