Financial Statement Translation Asian Opportunities wishes to include its wholly owned subsidiary in its consolidated financial statements.

Question:

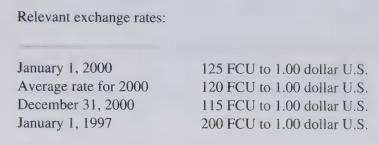

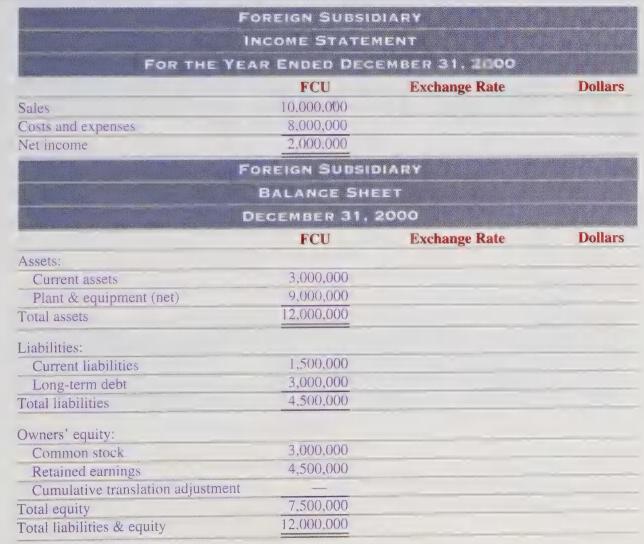

Financial Statement Translation Asian Opportunities wishes to include its wholly owned subsidiary in its consolidated financial statements. The financial statements of the subsidiary, stated in foreign currency units (FCU), are as follows:

The subsidiary was established on January 1, 1997, and Asian Opportunities acquired 100 percent of its common stock on that date for 3,000,000 FCU. The controller of Asian Opportunities has communicated with the company’s external accountants and learned that the proper retained earnings balance in U.S. dollars at December 31, 2000, is $20,000.

a. Translate the subsidiary’s financial statements into U.S.

dollars.

b. If the subsidiary is liquidated at December 31, 2000, with all assets sold at book value and its liabilities paid, what dollar amount would Asian Opportunities receive if it immediately converted the FCU received into U.S. dollars?

c. If the exchange rate of the FCU had remained at 200 FCU per dollar, would the cumulative translation adjustment at December 31, 2000, be larger or smaller than the amount computed in part a above? Explain why.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith