Financial Statement Translation World Companys Subsidiary A operates in Canada, and its financial statements are presented in

Question:

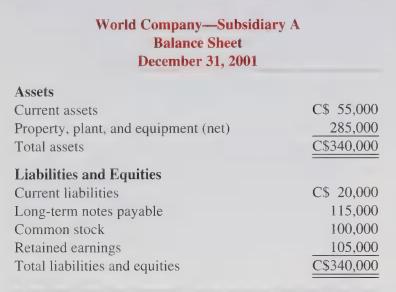

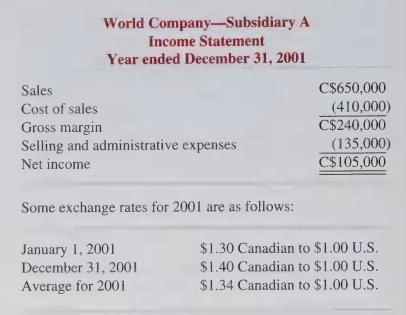

Financial Statement Translation World Company’s Subsidiary A operates in Canada, and its financial statements are presented in Canadian dollars. The subsidiary was established on January 1, 2001, and had no retained earnings at that date. It paid no dividends in 2001.

All revenues and expenses occurred uniformly throughout the year. World Company is located in the United States and must translate the subsidiary’s financial statement into U.S. dollars before preparing consolidated financial statements. Subsidiary A’s income statement and balance sheet appear as follows:

Prepare Subsidiary A’s income statement and balance sheet translated into U.S. dollars. Include the cumulative translation adjustment.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith