Minicase 1 Kellogg Company} Kellogg Company is the world's leading producer of ready-to-eat cereal products. In recent

Question:

Minicase 1 Kellogg Company}

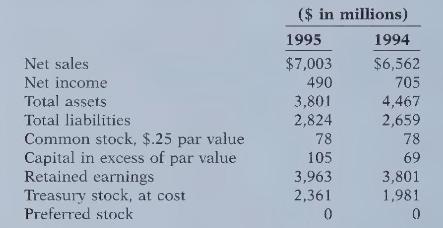

Kellogg Company is the world's leading producer of ready-to-eat cereal products. In recent years the company has taken numerous steps aimed at improving its profitability and earnings per share. Included in these steps was the layoff of 2,000 employees-roughly \(13 \%\) of Kellogg's workforce. In addition, Kellogg repurchased large amounts of its own shares: \(5,684,864\) in \(1995 ; 6,194,500\) in 1994; and 9,487,508 in 1993. It announced plans for significant additional repurchases in the coming year. The expenses for share repurchases were \(\$ 380\) million in 1995 , \(\$ 327\) million in 1994 , and \(\$ 548\) million in 1993 -that's nearly \(\$ 1.3\) billion dollars over a 3 -year period. The total amount expended for new property during this same period was \(\$ 1.1\) billion; thus, the company spent more money repurchasing stock than building the company. Also during this period the company issued \(\$ 400\) million in new debt. The table presents some basic facts for Kellogg Company:

The number of shares outstanding was \(222,000,000\) for 1994 and \(217,000,000\) for 1995 .

\section*{Instructions}

(a) What are some of the reasons that management purchases its own stock?

(b) What was the approximate impact on earnings per share of the common stock repurchases during this 3 -year period? That is, calculate earnings per share after the share repurchases and before the repurchases for 1995. (Use the total repurchases during the 3 -year period- \(-21,366,872\) shares-rounded to 21 million.)

(c) Calculate the debt to total assets ratios for 1994 and 1995 and discuss the implications of the change.

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471169192

1st Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso