Minicase 1 Texas Instruments} Texas Instruments designs and produces devices that use semiconductor technology. You may have

Question:

Minicase 1 Texas Instruments}

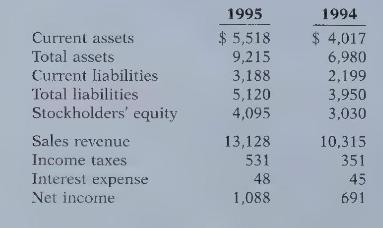

Texas Instruments designs and produces devices that use semiconductor technology. You may have one of its calculators on your desk. Because it is in a high-tech industry, the company must constantly invest in new technology, which requires considerable financing. During 1995 Texas Instruments' current liabilities and its long-term liabilities increased by about \(\$ 1\) billion each. Here is additional information (in millions) from Texas Instruments' 1995 annual report:

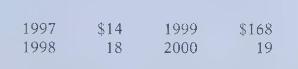

Maturities (in millions) of long-term debt due during the 4 years subsequent to December 31,1996 , are:

\begin{tabular}{rrrr}

1997 & \(\$ 14\) & 1999 & \(\$ 168\) \\

1998 & 18 & 2000 & 19 \end{tabular}

\section*{Instructions}

Address each of these questions related to the liabilities of Texas Instruments:

(a) Using both working capital and the current ratio as indicators, evaluate the change in the company's liquidity from 1994 to 1995.

(b) Using both the debt to total assets ratio and the times interest earned ratio, evaluate the change in the company's solvency from 1994 to 1995.

(c) What are the implications of the information provided about the maturities of the company's long-term debt?

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471169192

1st Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso