Perpetual Inventory Methods Clifton Enterprises uses a perpetual inventory system under which inventory costs and cost of

Question:

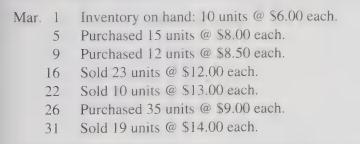

Perpetual Inventory Methods Clifton Enterprises uses a perpetual inventory system under which inventory costs and cost of goods sold are recomputed after each inventory transaction. During March, the company engaged in the following transactions:

The company vice president does not understand the effects of different inventory costing methods and has asked that you provide computations showing:

a. Ending inventory at March 31, and cost of goods sold for March, assuming the inventory costing method used is:

ifs Jel eOy yO:

3. Moving average (average inventory cost calculated after each purchase).

b. The cash savings or additional payment related to income taxes in March if Clifton Enterprises switches from FIFO to LIFO at March 1. Clifton’s current income tax rate is 30 percent.

c. President I. M. Simple is reluctant to switch from FIFO to LIFO for fear of obsolescence from keeping old inventory on hand while selling the latest units purchased. Are the president’s concerns valid? Explain.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith