Primary Assumptions Made in Preparing Financial Statements Millie Abrams opened a ceramic studio in leased retail space,

Question:

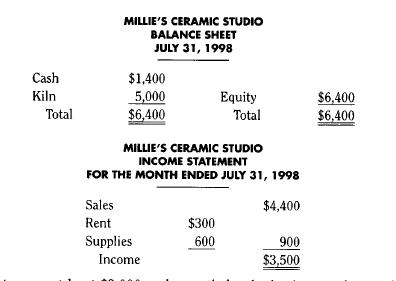

Primary Assumptions Made in Preparing Financial Statements Millie Abrams opened a ceramic studio in leased retail space, paying the first month's rent of $300 and a $1,000 security deposit with a check on her personal account. She took molds and paint, worth about $7,500, from her home to the studio. She also bought a new firing kiln to start the business. The new kiln had a list price of $5,000, but Millie was able to trade in her old kiln, worth $500 at the time of trade, on the new kiln, and therefore she paid only $4,500 cash. She wrote a check on her personal checking ac- count. Millie's first customers paid a total of $1,400 to attend classes for the next two months. She opened a checking account in the company's name with the $1,400. She has conducted classes for one month and has sold for $3,000 unfinished ceramic pieces called greenware. Greenware sales are all cash. Millie incurred $1,000 of personal cost in making the greenware. At the end of the first month, Millie prepared the following bal- ance sheet and income statement.

Millie needs to earn at least $3,000 each month for the business to be worth her time. She is pleased with the results.

Required Identify the assumptions that Millie has violated and explain how each event should have been handled. Prepare a corrected balance sheet and income statement.

Step by Step Answer:

Financial Accounting The Impact On Decision Makers

ISBN: 9780030270994

2nd Edition

Authors: Gary A. Porter, Curtis L. Norton