Property and Equipment of Toys R Us Toys R Us lists the following property and equipment in

Question:

Property and Equipment of Toys “R” Us Toys

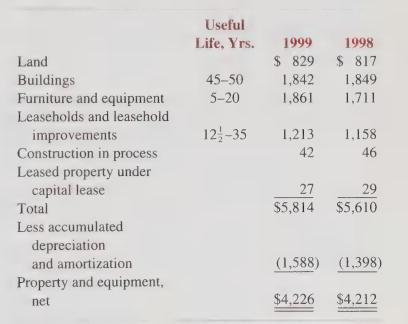

“R” Us lists the following property and equipment in its balance sheet (in millions of dollars):

The footnote disclosure in the company’s annual report explains the accounting methods for property and equipment, as follows:

Property and Equipment Property and equipment are recorded at cost. Depreciation and amortization are provided using the straightline method over the estimated useful lives of the assets or, where applicable, the terms of the respective leases, whichever is shorter.

The company’s 10-K filing with the SEC discloses the following additional information about property and equipment (in millions of dollars):

From the information presented, answer the following questions:

b. What is the historical cost of the land? Of the buildings?

c. Depreciation, amortization, and asset write-offs were $255 million in 1999. If there were no disposals of property and equipment during the year, what amount of these assets were acquired during the period?

. Which items are depreciated and which items are amortized?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith