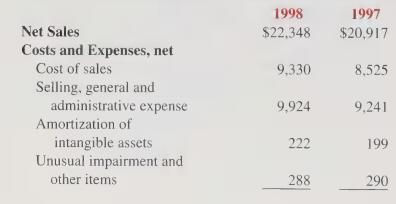

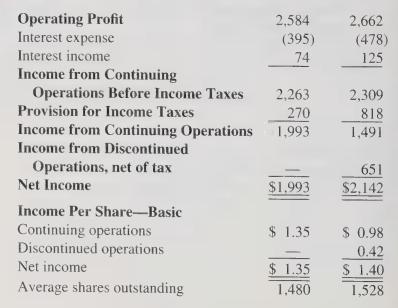

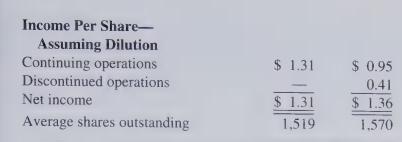

Reporting Income from PepsiCo The income statements for PepsiCo, Inc., and Subsidiaries for 1998 and 1997 contained

Question:

Reporting Income from PepsiCo The income statements for PepsiCo, Inc., and Subsidiaries for 1998 and 1997 contained the following information (stated in millions except per share amounts):

a. PepsiCo’s net income and earnings per share decreased from 1997 to 1998. What were the major factors causing the decline?

b. In projecting net income for 1999, would you anticipate net income and earnings per share will increase or continue to decrease? Explain.

c. In the notes to its financial statements, PepsiCo disclosed that in 1998 it recognized a tax benefit totaling $494 million as a result of a favorable settlement with the IRS and reduced its reported tax expense for 1998 by that amount.

Does this additional information change your response to part b? In what way?

d. In 1997, PepsiCo reorganized and transferred ownership of three of its subsidiaries to a new company and then distributed ownership of the newly created company to its shareholders. The income from discontinued operations of $651 million in 1997 represents the income earned by the subsidiaries prior to the transfer of ownership. What were the names of the three companies that were transferred to the new company by PepsiCo? (Hint: Information of this type is reported in annual reports, Moody’s Industrial Manual, SEC EDGAR files, company Web pages, and other investment sources).

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith