The draft income statement for the most recent reporting period of Barchester United Football Club plc has

Question:

The draft income statement for the most recent reporting period of Barchester United Football Club plc has reported a profit before tax of £48.8 million. An examination of the underlying records, however, shows that the following items need to be taken into account during the current period:

1. A provision for £15 million for restructuring the club was recognised in the preceding year. During the current year, the first phase of the restructuring was carried out and restructuring costs of £5.4 million were incurred. This amount has been charged to the current income statement.

2. A provision for a legal action against the club for unfair dismissal of the previous manager for £2.2 million was recognised in the preceding year. During the current year, the manager lost his case at an industrial tribunal and does not intend to appeal.

3. During the previous reporting period, a contingent asset was reported. This relates to an agreement to allow a television channel exclusive rights to televise reserve team matches. The agreement includes a formula for payment to Barchester United based on the number of television viewers per match (as measured by an independent body). A dispute over the precise interpretation of this formula led Barchester United to sue the television channel for £2 million in underpaid income. The court case to decide the issue recently ended abruptly when the television channel finally accepted (on the advice of its lawyers) that its interpretation of the formula had been incorrect.

4. The club spent £1 million during the year to help fund research studies on the main causes of football injuries among professional football players. This amount was capitalised and shown on the statement of financial position.

5. The club is building new training facilities for its players. The facilities are currently being constructed and will take three years to complete. During the current year, the club incurred £3.3 million in interest charges on the construction of the facilities. These were charged to the current income statement.

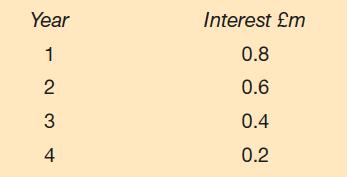

6. At the beginning of the year, the club took out a finance lease to acquire a new type of plastic all-weather turf for its new training ground. Annual lease payments, which are payable in arrears, are £1.5 million per year in each of the four years. The interest charge appearing in the draft income statement has been calculated on the basis that the total interest charge for the lease is allocated evenly over the lease period. The total interest charges should, however, be allocated as follows:

Required:

Calculate a revised profit before tax for the current reporting period, after taking account of the information shown above, and write brief notes to explain each adjustment that you have made to the draft profit before tax.

Step by Step Answer:

Financial Accounting For Decision Makers

ISBN: 9781292251257

9th Edition

Authors: Peter Atrill, Eddie McLaney