Tropic Investments is considering a project involving an initial cash outlay for an asset of 200,000. The

Question:

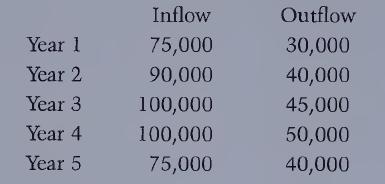

Tropic Investments is considering a project involving an initial cash outlay for an asset of £200,000. The asset is depreciated over five years at 20% p.a. (based on the value of the investment at the beginning of each year). The cash flows from the project are expected to be:

• What is the payback period?

• What is the return on investment (each year and average)?

• Assuming a cost of capital of 10% and ignoring inflation, what is the net present value of the cash flows? (Use the tables rather than a spreadsheet to answer this question.)

• Should the project be accepted?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting For Managers Interpreting Accounting Information For Decision Making

ISBN: 9780470777640

3rd Edition

Authors: Paul M. Collier

Question Posted: