Understanding Operating Assets UN You have been . asked to evaluate two companies and have acquired the

Question:

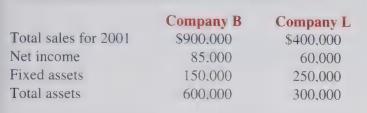

Understanding Operating Assets UN You have been . asked to evaluate two companies and have acquired the following information:

. Compute the fixed asset turnover ratios (sales/fixed assets)

and total asset turnover ratios (sales/total assets) for the companies. Which company appears to be the more desirable investment on the basis of these ratios?

. Compute the margin on sales ratio (net income/sales) and return on total assets ratio (net income/total assets) for the two companies. Which company appears to be the more desirable investment on the basis of these ratios?

. What factors may make it possible for Company B to have a smaller investment in fixed assets and still report more than double the sales of Company L?

. Although Company B reports greater net income than Company L, explain why it may be desirable to invest in Company L rather than Company B.

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith