From the following balance extracted from the books of accounts of Solid Steels Limited as on 31st

Question:

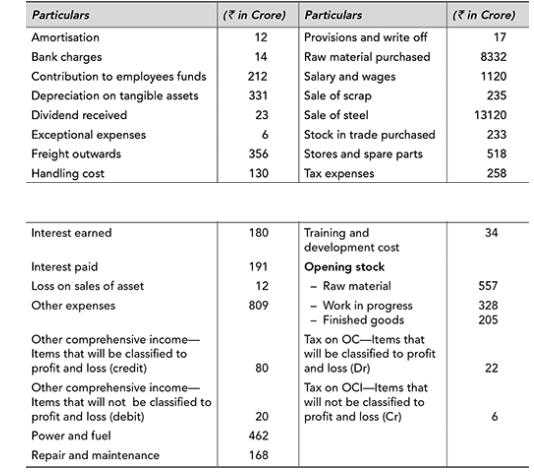

From the following balance extracted from the books of accounts of Solid Steels Limited as on 31st March 2017, prepare the statement of profit and loss.

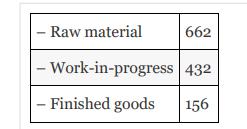

The closing stock as on 31st March 2017:

Transcribed Image Text:

Particulars Amortisation Bank charges Contribution to employees funds Depreciation on tangible assets Dividend received Exceptional expenses Freight outwards Handling cost Interest earned Interest paid Loss on sales of asset Other expenses Other comprehensive income- Items that will be classified to profit and loss (credit) Other comprehensive income- Items that will not be classified to profit and loss (debit) Power and fuel Repair and maintenance (in Crore) 12 14 212 331 23 6 356 130 180 191 12 809 80 20 462 168 Particulars Provisions and write off Raw material purchased Salary and wages Sale of scrap Sale of steel Stock in trade purchased Stores and spare parts Tax expenses Training and development cost Opening stock - Raw material - Work in progress - Finished goods Tax on OC-Items that will be classified to profit and loss (Dr) Tax on OCI-Items that will not be classified to profit and loss (Cr) (in Crore) 17 8332 1120 235 13120 233 518 258 34 557 328 205 22 6

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Use the trial balance and additional information given in Case 5.4 in Chapter 5 and prepare the balance sheet of HUL Limited as on 31st March 2017. Case 5.4 Hindustan Unilever Limited (HUL) is Indias...

-

Star Limited has an authorized capital of 600 million divided into 60 million equity shares of 10 each. The trial balance of the company for the year ended 31st March 2017 is as follows: Additional...

-

In continuation of Case 5.1 given in Chapter 5, you are required to prepare the balance sheet of Asian Paints Limited for the year ended 31st March 2017. The relevant information extracted from the...

-

To load and register a driver, creating a new instance of the Driver class method is better than using the Class.forName() method. (True/False)

-

How does an innovative culture make an organization more effective? Do you think an innovative culture could ever make an organization less effective? Why or why not?

-

Hilari and Northcott (2006) used a Social Support Survey (SSS) to gauge how well supported individuals suffering from stoke-induced aphasia (a language disorder) felt more than one year following the...

-

In some situations nonverbal signals are more effective than speech at communicating meaning. Linguistic barriers can make verbal communication uncertain or misleading in some cross-cultural...

-

Zelmer Company manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the president has installed a budgetary control system for 2017. The following data were used in...

-

Conduct a GAP analysis on Pfizer to expand in China's primary care segment

-

Explain the different measures of profit.

-

Deferred tax assets and deferred tax liabilities arise due to timing difference between taxable income and reported income. Explain the statement with suitable examples.

-

On December 1, 2021, Davenport Company sold merchandise to a customer for $20,000. In payment for the merchandise, the customer signed a 6% note requiring the payment of interest and principal on...

-

My first run at a dissertation was on Dr. Martin Luther King, Jr. When I was very young he walked through my hometown of Albany, Georgia. My father accompanied him, more to protect him than anything,...

-

Question 2 are charged, and the charge on sphere Y is The X and Y dots shown in the figure are two identical spheres, X and Y, that are fixed in place with their centers in the plane of the page....

-

how do i get the residuel income please help in just need the cell formula in excel 2 Genmure Corporation is trying to analyze the results of three efficiency initiatives that were taken on the...

-

Harlow Appliance has just developed a new air fryer it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the below information: a. New...

-

Based on the business that you created a global strategy for in the week 4 discussion, determine a low-cost & differentiation strategy in an effort to remain competitive in the global market. Include...

-

Prove each implication by contradiction, (a) If x and y are positive numbers, then x + y x + y. (b) If x is irrational and y is rational, then x + y is irrational. (c) If 13 people are selected, at...

-

For Problem estimate the change in y for the given change in x. y = f(x), f'(12) = 30, x increases from 12 to 12.2

-

Define conflict.

-

Explain contemporary perspectives of conflict.

-

Contrast task, relationship, and process conflict.

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App