Question:

Use the trial balance and additional information given in Case 5.4 in Chapter 5 and prepare the balance sheet of HUL Limited as on 31st March 2017.

Case 5.4

Hindustan Unilever Limited (HUL) is India’s largest Fast Moving Consumer Goods company. HUL has over 35 brands spanning 20 distinct categories such as soaps, detergents, shampoos, skin care, toothpastes, deodorants, cosmetics, tea, coffee, packaged foods, ice cream, and water purifiers. The Company has about 18,000 employees.

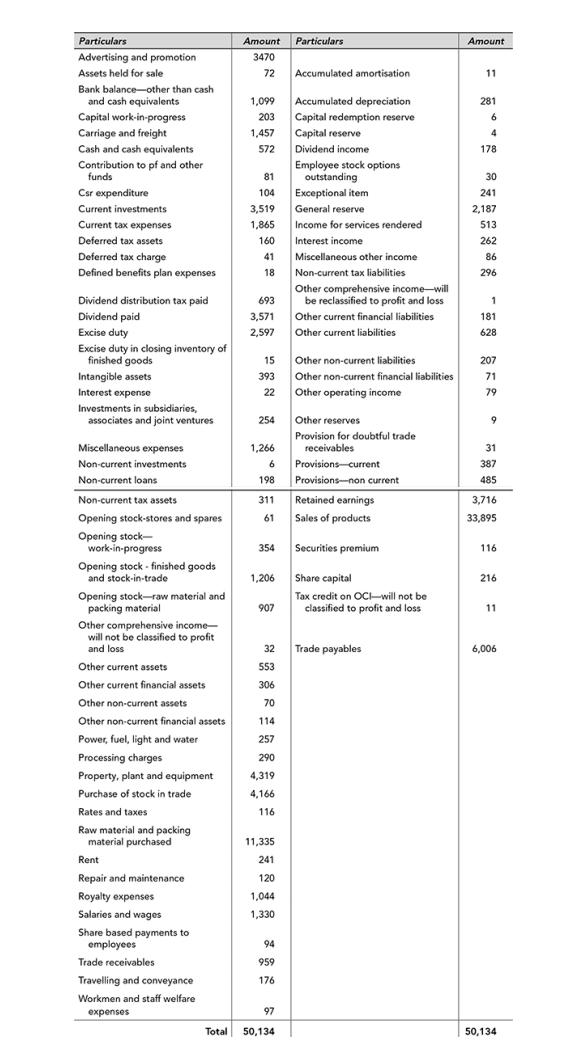

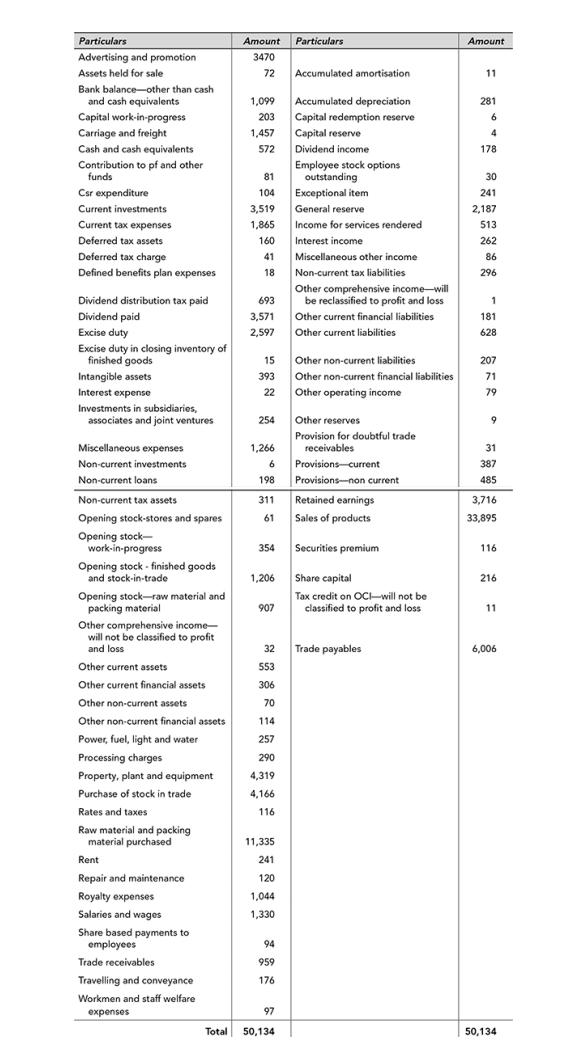

From the following Trial Balance of the company and additional information, you are required to prepare the Statement Profit and Loss for the company for the year ended 31st March 2017.

Additional Information

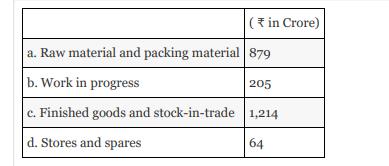

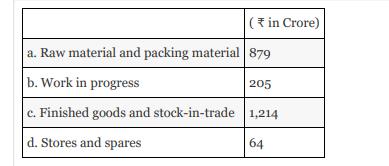

1. Closing inventories as on 31st March 2017 consists of:

2. Provide depreciation on property, plant and equipment: ₹ 384 crore.

3. Amortise intangible assets: ₹ 12 crore.

Transcribed Image Text:

Particulars

Advertising and promotion.

Assets held for sale

Bank balance-other than cash

and cash equivalents

Capital work-in-progress

Carriage and freight

Cash and cash equivalents

Contribution to pf and other

funds

Csr expenditure

Current investments

Current tax expenses

Deferred tax assets

Deferred tax charge

Defined benefits plan expenses

Dividend distribution tax paid

Dividend paid

Excise duty

Excise duty in closing inventory of

finished goods

Intangible assets

Interest expense

Investments in subsidiaries,

associates and joint ventures

Miscellaneous expenses

Non-current investments

Non-current loans.

Non-current tax assets

Opening stock-stores and spares

Opening stock-

work-in-progress

Opening stock - finished goods

and stock-in-trade

Opening stock-raw material and

packing material

Other comprehensive income-

will not be classified to profit

and loss

Other current assets

Other current financial assets

Other non-current assets

Other non-current financial assets

Power, fuel, light and water

Processing charges

Property, plant and equipment

Purchase of stock in trade.

Rates and taxes

Raw material and packing

material purchased

Rent

Repair and maintenance

Royalty expenses

Salaries and wages

Share based payments to

employees

Trade receivables

Travelling and conveyance

Workmen and staff welfare

expenses

Total

Amount

3470

72

1,099

203

1,457

572

81

104

3,519

1,865

160

41

18

693

3,571

2,597

15

393

22

254

1,266

6

198

311

61

354

1,206

907

32

553

306

70

114

257

290

4,319

4,166

116

11,335

241

120

1,044

1,330

94

959

176

97

50,134

Particulars

Accumulated amortisation

Accumulated depreciation

Capital redemption reserve

Capital reserve

Dividend income

Employee stock options

outstanding

Exceptional item

General reserve

Income for services rendered

Interest income

Interest income

Miscellaneous other income

Non-current tax liabilities

Other comprehensive income-will

be reclassified to profit and loss

Other current financial liabilities

Other current liabilities

Other non-current liabilities

Other non-current financial liabilities

Other operating income

Other reserves

Provision for doubtful trade

receivables

Provisions-current

Provisions-non current

Retained earnings

Sales of products

Securities premium

Share capital

Tax credit on OCI will not be

classified to profit and loss

Trade payables

Amount

11

281

6

4

178

30

241

2,187

513

262

86

296

1

181

628

207

71

79

9

31

387

485

3,716

33,895

116

216

11

6,006

50,134