Question:

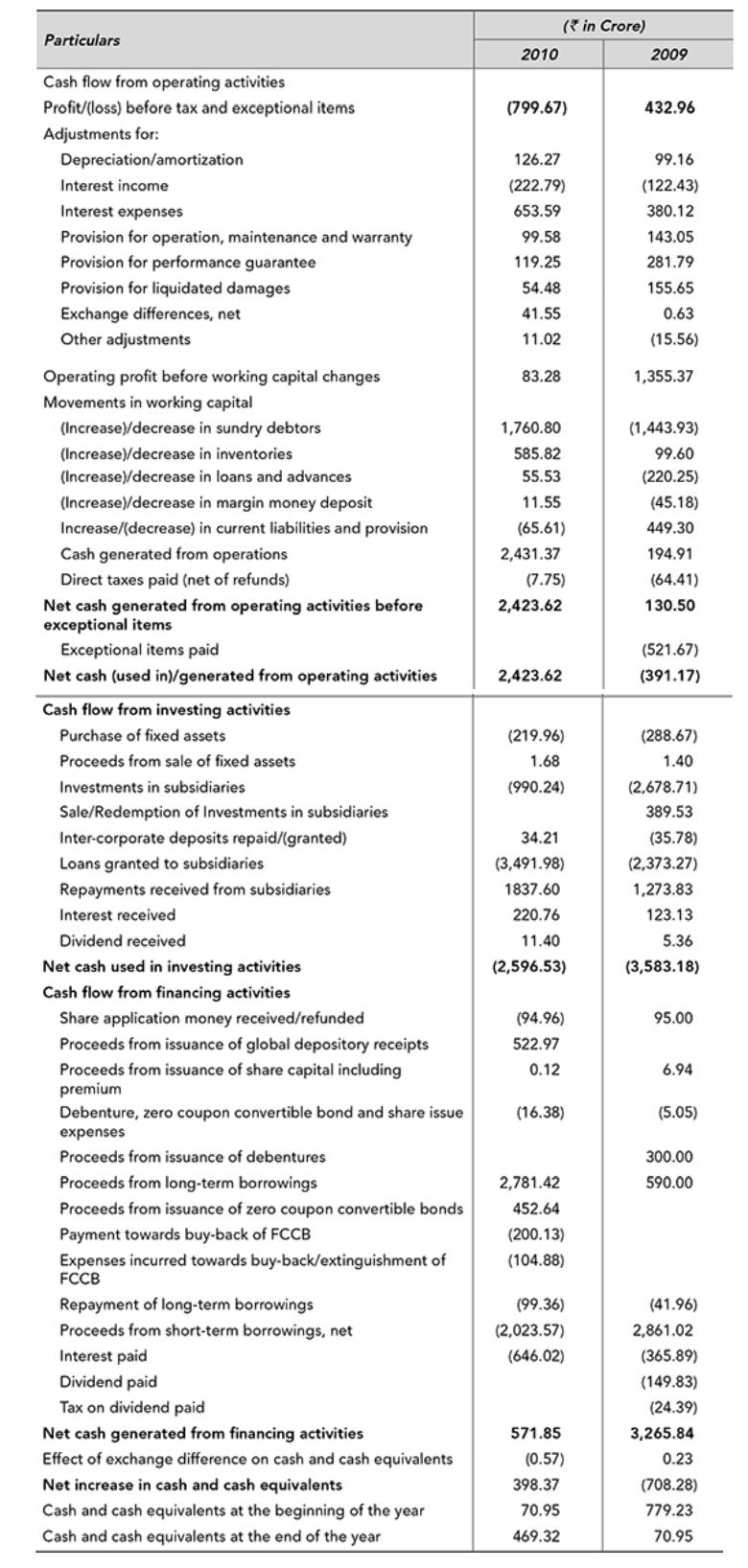

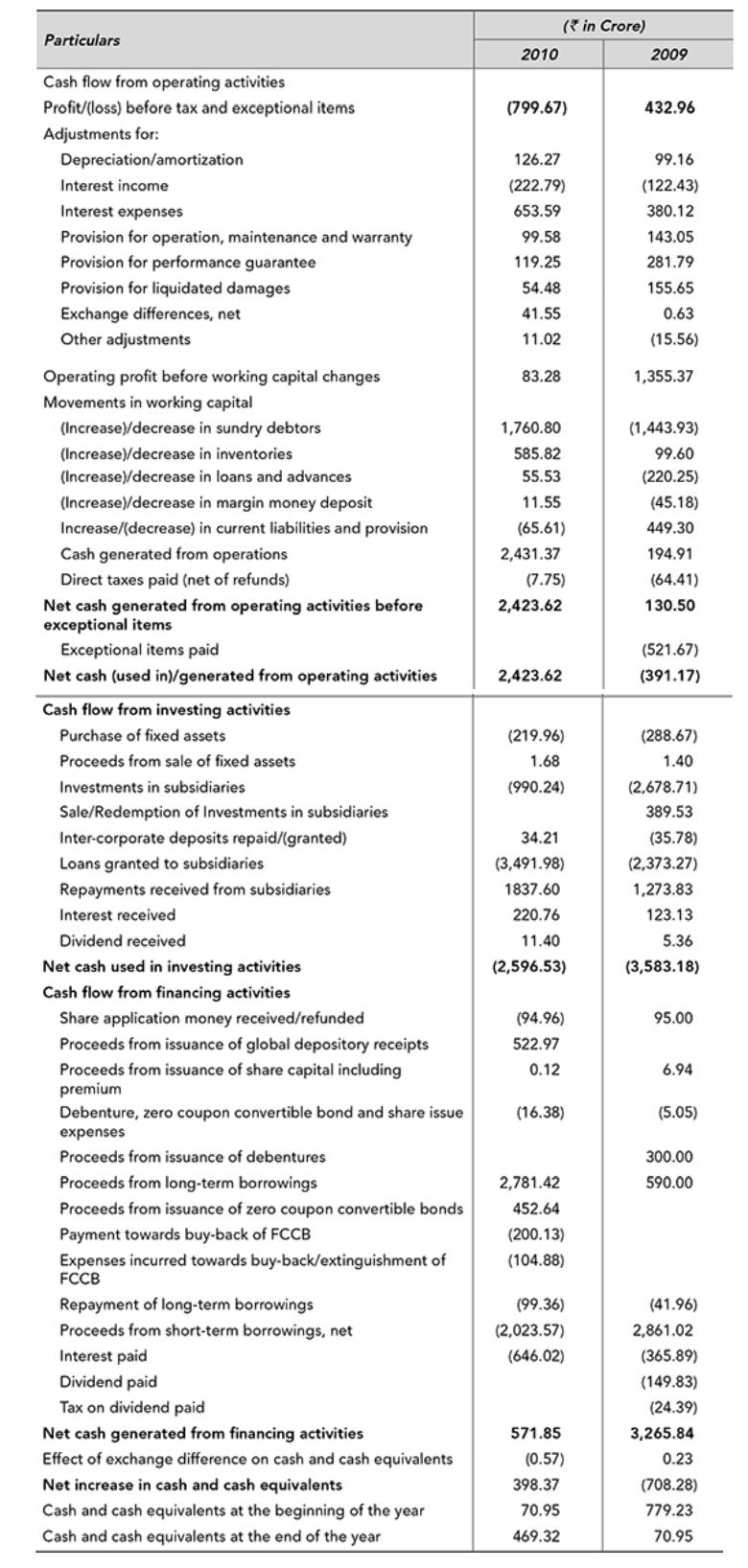

Suzlon Energy Limited, founded in the year 1995, is a leading wind power company. It has presence in 21 countries in the continents of America, Asia, Australia and Europe. It has emerged as the third largest wind power supplier. The year 2009–10 proved to be a disappointing year for Suzlon as it suffered its first full year loss. The economic downturn had a significant impact on lowering demand—and therefore the relative price—of energy. During these difficult times, the company’s management of cash is depicted in the cash flow statements for the year 2008–09 and 2009–10 as follows.

Cash Flow Statement for the Year Ended 31st March

Questions for Discussion

1. For the year 2009, the company earned a profit before tax of ₹ 432.96 crore but its cash flow from operating activities was negative (−₹ 391.17 crore). In the next year, the company suffered a loss (−₹ 799.67 crore) but the cash flow from operating activities was positive ( ₹ 2,423.62 crore). Identify the main reasons for the same.

2. What has happened to debtors’ position in the year 2009 and 2010?

3. Indentify and analyse major uses of cash towards investing activities.

4. Analyse the major financing activities of Suzlon during 2009 and 2010.

Transcribed Image Text:

Particulars

Cash flow from operating activities

Profit/(loss) before tax and exceptional items

Adjustments for:

Depreciation/amortization

Interest income

Interest expenses

Provision for operation, maintenance and warranty

Provision for performance guarantee

Provision for liquidated damages

Exchange differences, net

Other adjustments

Operating profit before working capital changes

Movements in working capital

(Increase)/decrease in sundry debtors

(Increase)/decrease in inventories

(Increase)/decrease in loans and advances

(Increase)/decrease in margin money deposit

Increase/(decrease) in current liabilities and provision

Cash generated from operations

Direct taxes paid (net of refunds)

Net cash generated from operating activities before

exceptional items

Exceptional items paid

Net cash (used in)/generated from operating activities

Cash flow from investing activities

Purchase of fixed assets

Proceeds from sale of fixed assets

Investments in subsidiaries

Sale/Redemption of Investments in subsidiaries

Inter-corporate deposits repaid/(granted)

Loans granted to subsidiaries

Repayments received from subsidiaries

Interest received

Dividend received

Net cash used in investing activities

Cash flow from financing activities

Share application money received/refunded

Proceeds from issuance of global depository receipts

Proceeds from issuance of share capital including

premium

Debenture, zero coupon convertible bond and share issue

expenses

Proceeds from issuance of debentures

Proceeds from long-term borrowings

Proceeds from issuance of zero coupon convertible bonds

Payment towards buy-back of FCCB

Expenses incurred towards buy-back/extinguishment of

FCCB

Repayment of long-term borrowings

Proceeds from short-term borrowings, net

Interest paid

Dividend paid

Tax on dividend paid

Net cash generated from financing activities

Effect of exchange difference on cash and cash equivalents

Net increase in cash and cash equivalents

Cash and cash equivalents at the beginning of the year

Cash and cash equivalents at the end of the year

2010

(799.67)

( in Crore)

126.27

(222.79)

653.59

99.58

119.25

54.48

41.55

11.02

83.28

1,760.80

585.82

55.53

11.55

(65.61)

2,431.37

(7.75)

2,423.62

2,423.62

(219.96)

1.68

(990.24)

34.21

(3,491.98)

1837.60

220.76

11.40

(2,596.53)

(94.96)

522.97

0.12

(16.38)

2,781.42

452.64

(200.13)

(104.88)

(99.36)

(2,023.57)

(646.02)

571.85

(0.57)

398.37

70.95

469.32

2009

432.96

99.16

(122.43)

380.12

143.05

281.79

155.65

0.63

(15.56)

1,355.37

(1,443.93)

99.60

(220.25)

(45.18)

449.30

194.91

(64.41)

130.50

(521.67)

(391.17)

(288.67)

1.40

(2,678.71)

389.53

(35.78)

(2,373.27)

1,273.83

123.13

5.36

(3,583.18)

95.00

6.94

(5.05)

300.00

590.00

(41.96)

2,861.02

(365.89)

(149.83)

(24.39)

3,265.84

0.23

(708.28)

779.23

70.95