AT&T reports the following footnote to its 2005 10-K report ($ millions). Equity Method Investments We account

Question:

AT&T reports the following footnote to its 2005 10-K report ($ millions).

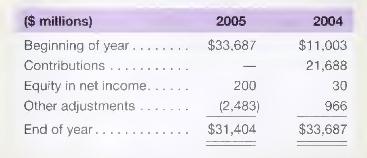

Equity Method Investments We account for our nationwide wireless joint venture, Cingular, and our investments in equity affiliates under the equity method of accounting. The following table is a reconciliation of our investments in and advances to Cingular as presented on our Consolidated Balance Sheets.

Undistributed earnings from Cingular were \$2,711 and \$2,511 at December 31, 2005 and 2004. "Other adjustments" in 2005 included the net activity of \(\$ 2,442\) under our revolving credit agreement with Cingular, consisting of a reduction of \(\$ 1,747\) (reflecting Cingular's repayment of their shareholder loan during 2005) and a decrease of \(\$ 695\) (reflecting Cingular's net repayment of their revolving credit balance during 2005). During 2004, we made an equity contribution to Cingular in connection with its acquisition of AT\&T Wireless. "Other adjustments" in 2004 included the net activity of \(\$ 972\) under our revolving credit agreement with Cingular, consisting of a reduction of \(\$ 30\) (reflecting Cingular's repayment of advances during 2004) and an increase of \(\$ 1,002\) (reflecting the December 31, 2004 balance of advances to Cingular under this revolving credit agreement).

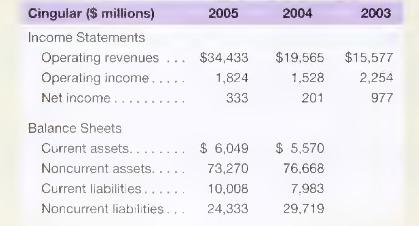

We account for our \(60 \%\) economic interest in Cingular under the equity method of accounting in our consolidated financial statements since we share control equally (i.e., \(50 / 50\) ) with our \(40 \%\) economic partner in the joint venture. We have equal voting rights and representation on the Board of Directors that controls Cingular. The following table presents summarized financial information for Cingular at December 31, or for the year then ended.

We have made a subordinated loan to Cingular that totaled \(\$ 4,108\) and \(\$ 5,855\) at December 31, 2005 and 2004, which matures in June 2008. This loan bears interest at an annual rate of \(6.0 \%\). During 2005, Cingular repaid \(\$ 1,747\) to reduce the balance of this loan in accordance with the terms of a revolving credit agreement. We earned interest income on this loan of \(\$ 311\) during 2005, \$354 in 2004 and \(\$ 397\) in 2003. This interest income does not have a material impact on our net income as it is mostly offset when we record our share of equity income in Cingular.

a. At what amount is the equity investment in Cingular reported on AT\&T's balance sheet? (Hint: the table in the footnote reports AT\&T's investment plus its "advances" of \(\$ 4,108\) to Cingular plus

\(\$ 311\) of interest accrued on the advances.) Next, confirm (with computations) that this amount is equal to AT\&T's proportionate share of Cingular's equity

b. Did Cingular pay out any of its earnings as dividends in 2005? How do you know?

c. How much income did AT\&T report in 2005 relating to this investment in Cingular?

d. Interpret the AT\&T statement that "undistributed earnings from Cingular were \(\$ 2,711\) and \(\$ 2,511\) at December 31, 2005 and 2004."

e. How does use of the equity method impact AT\&T's ROE and its RNOA components (net operating asset turnover and net operating profit margin)?

f. AT\&T accounts for its investment in Cingular under the equity method, despite its \(60 \%\) economic ownership position. Why?

g. In 2006, AT\&T merged with Bell South, its joint venture partner in Cingular. What impact will this merger have on the way AT\&T accounts for its investment in Cingular?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally