CNA Financial Corporation provides the following footnote to its (200710-mathrm{K}) report. Valuation of investments CNA classifies its

Question:

CNA Financial Corporation provides the following footnote to its \(200710-\mathrm{K}\) report.

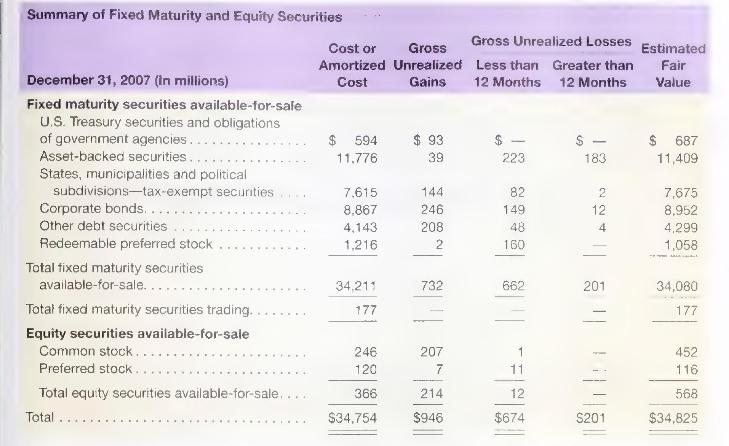

Valuation of investments CNA classifies its fixed maturity securities (bonds and redeemable preferred stocks) and its equity securities as either available-for-sale or trading, and as such, they are carried at fair value. Changes in fair value of trading securities are reported within net investment income. The amortized cost of fixed maturity securities classified as available-forsale is adjusted for amortization of premiums and accretion of discounts to maturity, which are included in net investment income. Changes in fair value related to available-for-sale securities are reported as a component of other comprehensive income. Investments are written down to fair value and losses are recognized in Realized investment gains (losses) on the Consolidated Statements of Operations when a decline in value is determined to be other-than-temporary.

The following table provides a summary of fixed maturity and equity securities investments.

a. At what amount does CNA report its investment portfolio on its balance sheet? In your answer identify the portfolio's fair value, cost, and any unrealized gains and losses.

b. How do CNA's balance sheet and income statement reflect any unrealized gains and/or losses on the investment portfolio?

c. How do CNA's balance sheet and income statement reflect gains and losses realized from the sale of available-for-sale securities?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally