Consider a publicly held company whose products you are familiar with. Some examples might include: Access the

Question:

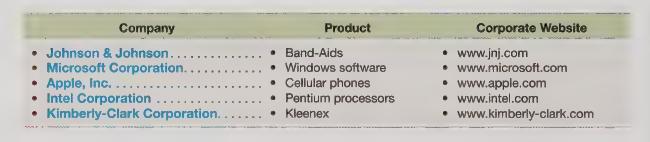

Consider a publicly held company whose products you are familiar with. Some examples might include:

Access the company’s public website and search for its most recent annual report. (Some companies will provide access to their financial data through an “investor relations” link, while others will provide a direct link to their “annual reports.”) After locating your company’s most recent annual report, open the file and review its contents. After reviewing the annual report for your selected company, prepare answers to the following questions:

a. Prepare common-size income statements and common-size balance sheets for the past two years. What significant trends can you identify from these common-size statements?

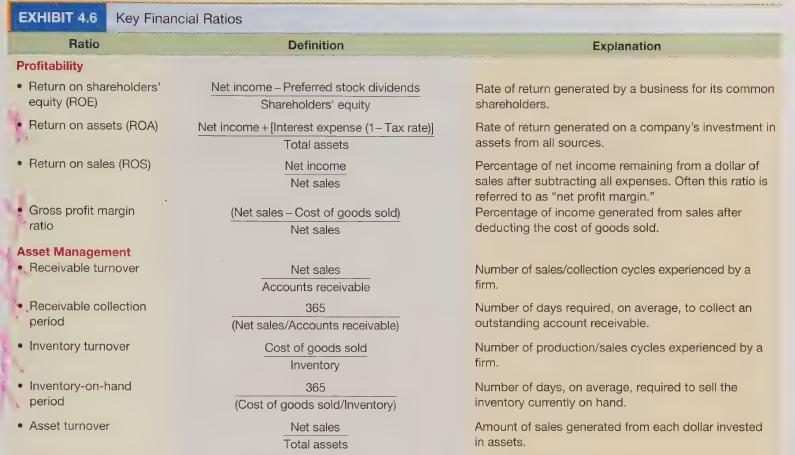

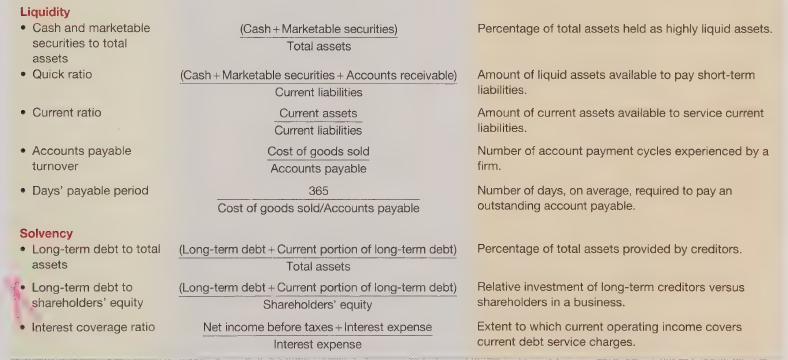

b. Calculate the following ratios for the past two years. (Use the ratio definitions in Exhibit 4.6.)

Gross profit margin ratio Cash and marketable securities to total assets

Return on sales Quick ratio

Return on assets Current ratio

Return on shareholders’ equity Accounts payable turnover

Receivable turnover Days’ payable period

Receivable collection period Long-term debt to total assets

Inventory turnover Long-term debt to shareholders’ equity

Inventory-on-hand period Interest coverage ratio

Asset turnover

What significant trends in the company’s profitability, asset management, liquidity, or solvency can you identify from your calculations?

c. Identify several key competitors of your selected company. Go to Yahoo.Finance.com and benchmark your company against its key competitors on the following metrics:

Market capitalization Return on assets Return on sales Return on equity

d. Review the company’s long-term debt footnotes. Is the company subject to any debt covenants? If so, what are the covenants and is the company currently in compliance with the covenant(s)?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris